Editorial | Chan needs to make correct diagnosis in Hong Kong’s post-Covid budget

- With Hong Kong still recovering from the devastating coronavirus, its financial chief will have to balance public expectations against shrinking reserves

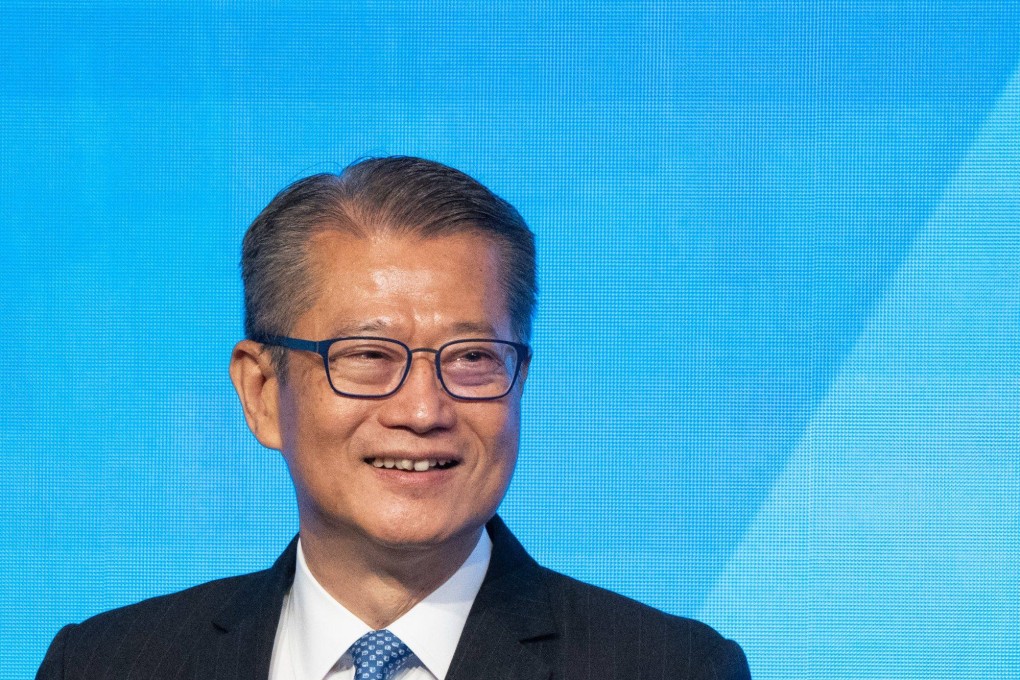

Balancing public expectations with financial prudence has always been a delicate but essential part of the government budget process. Following a prolonged pandemic that has taken a heavy toll on the economy and public coffers, the first fiscal blueprint by the new administration on Wednesday has become all the more challenging. Financial Secretary Paul Chan Mo-po must seize the post-Covid momentum to rebuild the city while providing relief to those who are still struggling from the fallout of the health crisis.

The city was sinking into the most deadly fifth wave of Covid-19 around this time last year. Many businesses were ordered to shut to help curb the coronavirus, and social-distancing rules were further tightened. The multibillion-dollar budget deficit continued to balloon as the government dished out more wage subsidies and relief measures. Only until late last year were restrictions gradually eased, but the road to normality remains a long one.

Chan is a safe pair of hands, having overseen budgets for three consecutive administrations since 2017. What sets the coming one apart is not only that it is the first for the new government, but also the city’s first post-Covid budget. As we enter a new chapter following years of political and economic turmoil, there are also wide-ranging demands from several sectors.

The receding pandemic has allowed more leeway to manoeuvre. Ambitious promotion drives have been launched to return the city to the world stage. Tourists are coming back following the border reopening, and the jobless rate continues to ease while applications under a talent admission scheme are flooding in. Such positive signs bode well for the future. The government must make good use of the opportunity to explore new engines of growth and development.

But the challenges ahead are daunting. Despite the strong fundamentals, the economy is undergoing rapid restructuring fuelled by intensifying global competition and geopolitical tensions. Rising interest rates are pushing up business costs. A manpower shortage owing to Covid-induced job losses and an ongoing exodus is still slowing the pace of recovery.

Equally worthy of concern is the pressure for relief measures. Even though the worst time is seemingly over, the aftermath of the pandemic is still being felt. Meanwhile, the clamour for another round of consumption voucher prevails. The city is fortunate to have enviable fiscal reserves, but they are shrinking fast as a result of additional Covid-related spending, dwindling land sales and other setbacks in recent years. The need to boost revenues has also become stronger. How to strike a balance and put the city back on track will be a major test for the financial secretary.