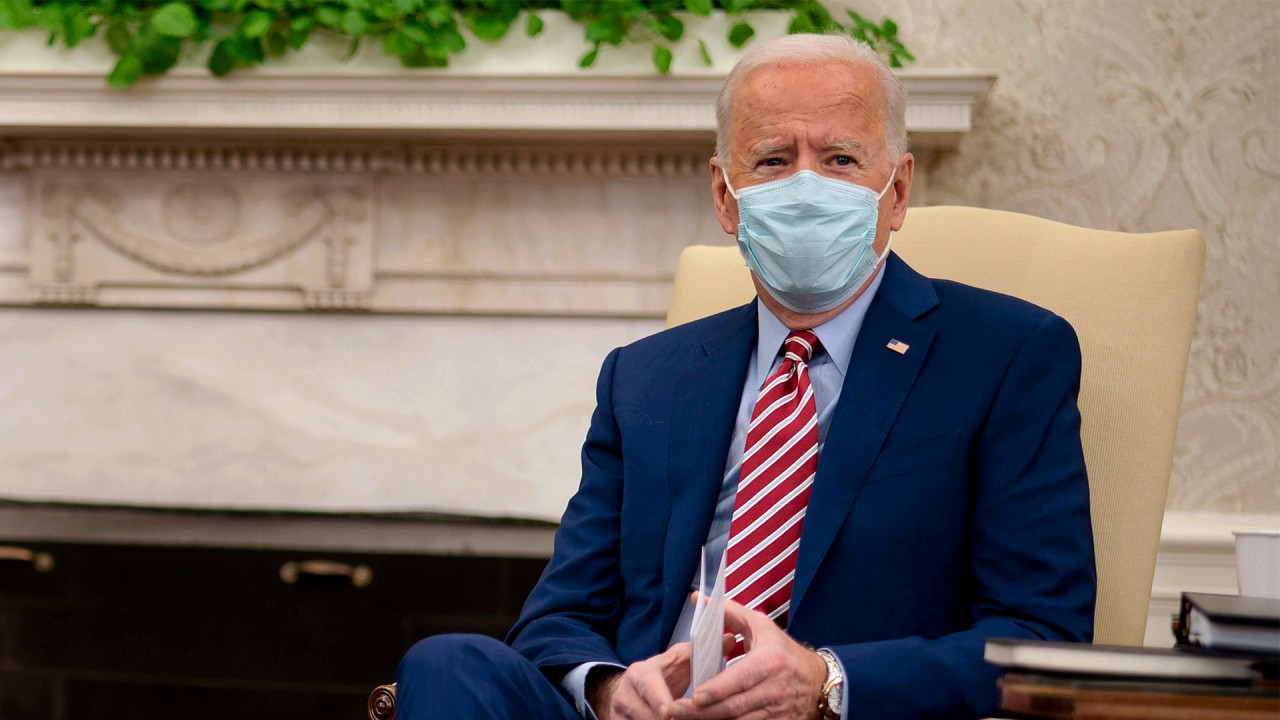

Macroscope | Biden’s US$2.25 trillion infrastructure plan boldly recognises public sector role

- US corporate taxes will rise to help fund the infrastructure upgrade and social welfare spending that the US will need to catch up with front-runner China

- The Biden plan is a tacit recognition that financial systems in market economies such as the US are not best suited to financing public spending

That the infrastructure spending will be financed chiefly by an estimated US$1.6 trillion of extra corporate US taxes, phased in over 15 years, is remarkable in a country where market financing and operation of infrastructure facilities has been strongly favoured over public provision in recent decades. The Biden plan is a tacit recognition that financial systems in market economies such as the US, parts of Europe and elsewhere which follow Anglo-Saxon principles of putting shareholder interests ahead of stakeholder interests, are not best suited to financing public spending.

Poor infrastructure is often accompanied by low productivity and other economic inefficiencies and in this sense, the Biden package could do more to make America great again than anything Donald Trump ever did while in the White House.