Why China turns a blind eye to VIE tech firms and their foreign investors

- As long as variable interest entities continue to raise foreign capital to boost China’s economy, without threatening it or Beijing, there is no danger of a regulatory crackdown

Since Chinese variable interest entity (VIE) companies made their debut in the early 2000s in the first wave of the internet economy, once in a while, international lawyers and investment bankers get anxious and ask: when is China going to crack down on VIE structures?

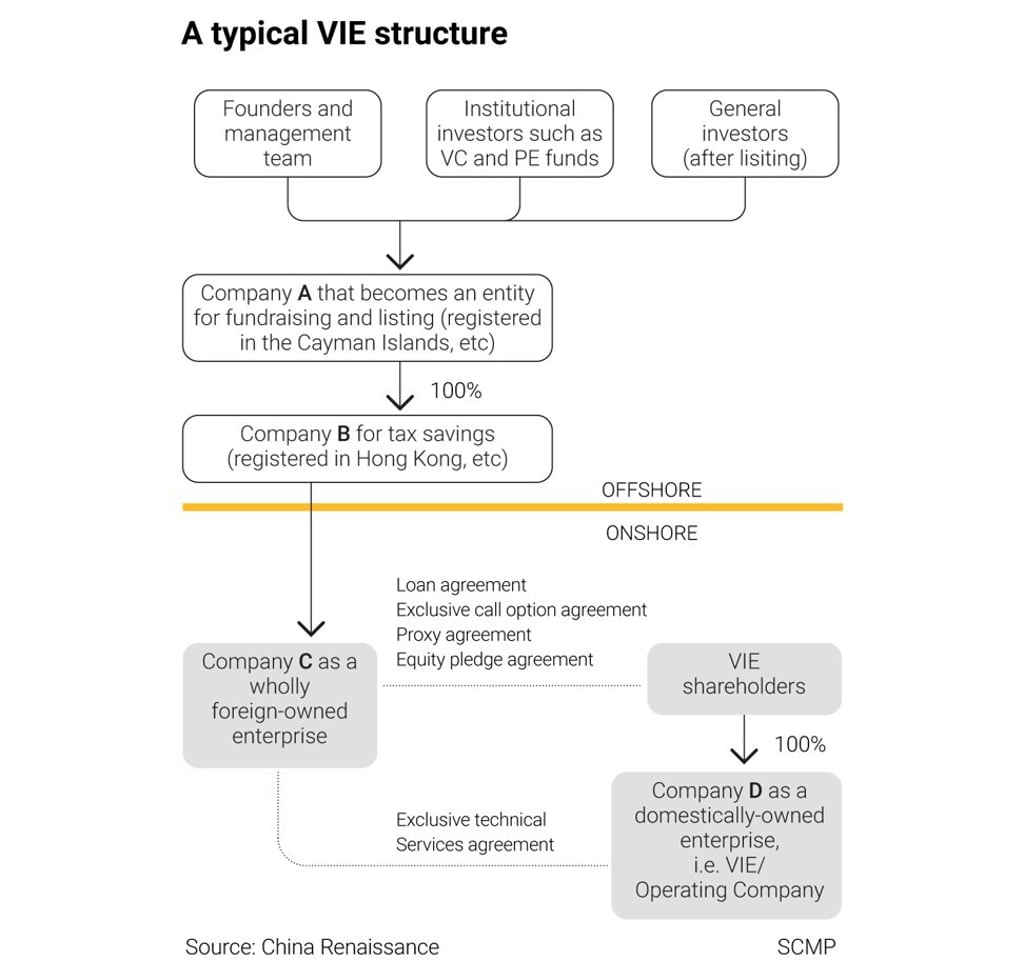

Under this structure, the revenues of Chinese-owned VIEs, under service contracts, can flow into wholly foreign-owned entities, benefiting international investors.

The contracts are essential. Without them, international investors cannot reap the financial benefits of the Chinese businesses they have put money in. The contractual facade lets Chinese regulators look away as the entities that directly conduct business in the restricted domains are companies owned by Chinese nationals.