Why China must tread carefully on dumping US debt

- If Beijing is anxious about US sovereign credit risks, there are other investment options like the euro and gold, but they come with consequences on prices and exchange rates

- After four years of trade tensions, the foremost task is for both sides to repair frayed relations

After nearly four years of damaging trade tensions between the United States and China, a stabilisation of relations is long overdue. The US, China and the global economy need to get back onto a stronger footing and a trade detente seems the best way forward.

Beijing has been gradually scaling back holdings of US Treasuries for a number of years. The latest data shows that China’s holdings of US Treasury securities fell to US$1.06 trillion in September, down from a peak of US$1.3 trillion in 2013, still representing a sizeable 15 per cent chunk of US Treasuries held abroad.

Of course, the move may be no more than a measure to reduce potential risk exposure, given the surging debt levels in the US.

02:39

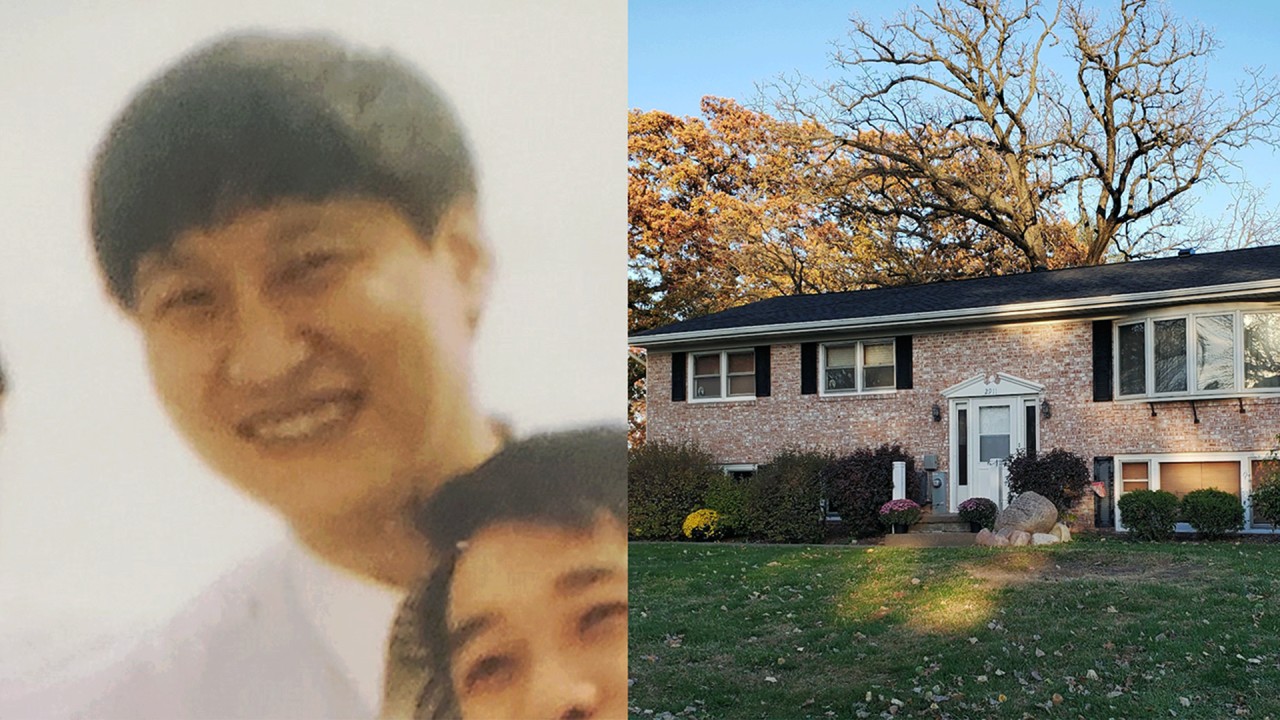

Once a symbol of promising US-China ties, Iowa house Xi Jinping stayed in 1985 now empty

Thanks to the coronavirus crisis, the US budget deficit is ballooning and presenting a massive debt problem for the government.