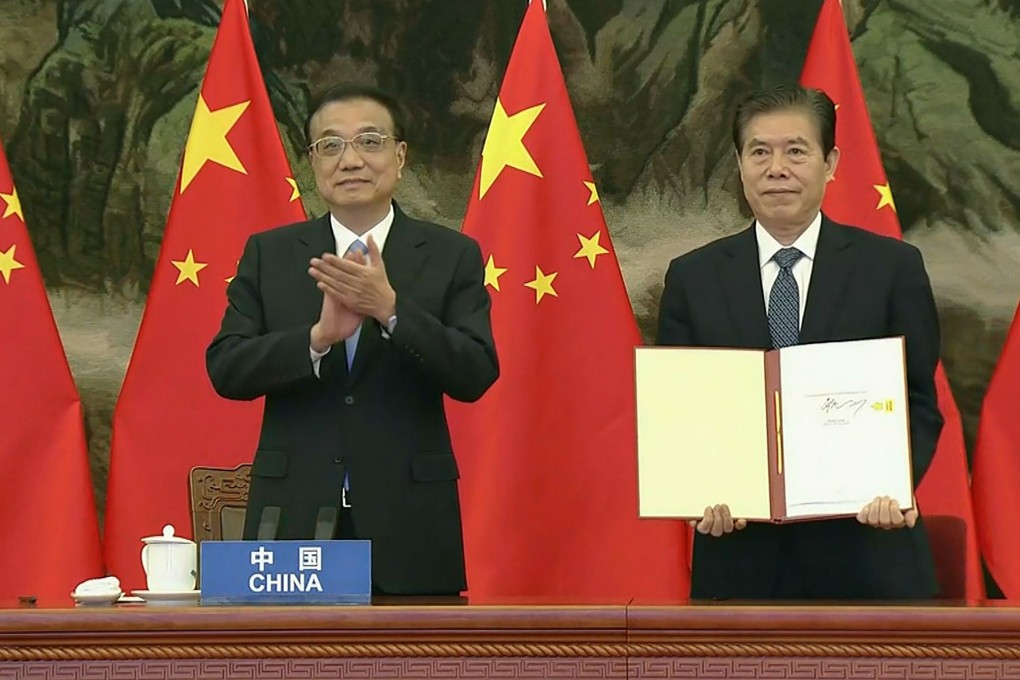

With the RCEP, China finally has a seat at the trade and policy table

- As the dominant economy in the world’s largest trading bloc, China finally has institutional voice and a chance to establish its preferred rules and standards

It’s necessary to view the wider picture around the RCEP launch to understand how this “detail” fits into China’s overall designs. And that means looking back at events over the past decade or more, especially over the past five years.

The US was for long the “top dog” not only in terms of economic size but also in terms of institutional clout, and thus, a regional and international standards setter. The privilege this role confers is potentially enormous, yet perhaps not sufficiently well understood.

The US has also exerted effective control over the world’s leading multilateral institutions (many of which it was instrumental in creating) including the Bretton Woods twins – the International Monetary Fund and the World Bank – regional development banks such as the Asian Development Bank, plus the World Trade Organisation, World Health Organisation and so on.