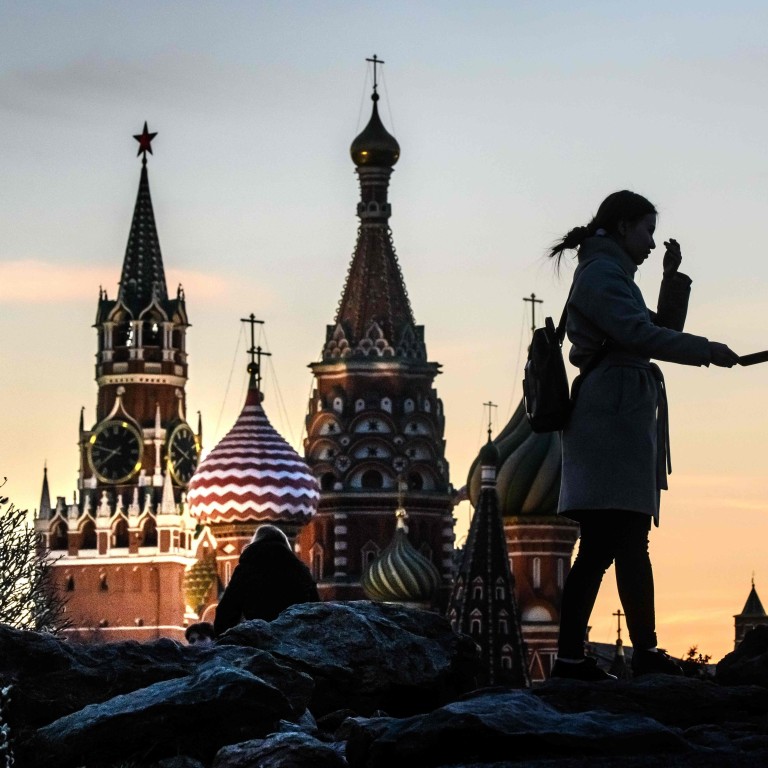

Coronavirus pandemic’s hit to Russia’s economy should prompt structural reform

- While projections suggest the pandemic will not hurt the Russian economy as badly as feared, stagnation and inefficiency continue to hold back its growth

- The Kremlin should institute deep structural reforms to boost growth and avoid a worsening deficit, but there are few signs it will change its domestic policies

Russia’s economy is doing better than many anticipated, but its medium-term trajectory still looks bleak. Declining oil revenue, crackdowns on investors and threats of new sanctions contribute to gloomy forecasts with marginal chances for improvement.

Even before the pandemic, economic growth had been sluggish. In 2019, Russian authorities pledged to accelerate economic expansion and announced state spending of roughly US$400 billion across six years in key areas such as infrastructure and education.

The ambitious plan driven by notoriously inefficient state investments was received with scepticism, but it was still a positive step that could have re-energised the stagnating economy. The government reported that gross domestic product grew 1.3 per cent in 2019, down from 2.5 per cent a year earlier.

02:03

Russia approves ‘world’s first’ Covid-19 vaccine, President Vladimir Putin says

In April, the government estimated that in the worst-case scenario, its GDP would shrink up to 10 per cent this year. Russian Finance Minister Anton Siluanov said the “prosperous times” for the Russian economy were over as the country was unlikely to return to the high oil revenues of the 2000s.

Fears of a prolonged recession were further supported by grim data. In May, the finance ministry’s monthly budget update showed that in April GDP had contracted by 28 per cent in nominal terms.

The economy eventually fared better than anticipated. In August, official data showed Russia’s GDP fell 8.5 per cent in the second quarter and 3.6 per cent in the first half of 2020.

Recently, investment bank Renaissance Capital optimistically projected that Russia’s GDP will contract by 3.3 per cent this year and record a 3.8 per cent rebound in 2021. Presidential aide Maxim Oreshkin said in August that Russia could become one of the world’s top five economies in terms of purchasing power parity as early as this year.

China-Russia economic ties will emerge strong after Covid-19

In addition to tax increases, Russia will increase borrowing, boosting the public debt load by about 50 per cent. The unusual growth in debt and increased economic spending shows the government is worried about the consequences of declining oil revenue.

One discussion paper says Russia’s poverty rate increased from 12.5 per cent to 20 per cent since the beginning of the pandemic. It is unclear what could stimulate economic growth while still preserving the millions of inefficient jobs that have helped sustain Russian President Vladimir Putin’s high approval ratings, let alone boost real incomes that have fallen for the past six years.

Why a Joe Biden presidency is likely to be bad news for Russia

Russia is also infamous for its poor handling of investors and businessmen. In 2018, Russian courts charged more than 7,700 businessmen, 20 per cent more than a year earlier and almost twice as many as in 2014. The lack of an independent judiciary, combined with massive red tape, allow security forces to make legal arguments that businessmen have little chance to appeal against.

Little wonder, then, that Russia has struggled as an investment destination. The last five years have seen some of its lowest volumes of foreign direct investment since the demise of the Soviet Union.

Russia’s good economic performance relative to other countries during the pandemic shouldn’t distort its actual outlook. The Russian economy continues to stagnate, and many problems are worsening.

Dmitriy Frolovskiy is a political analyst and independent journalist