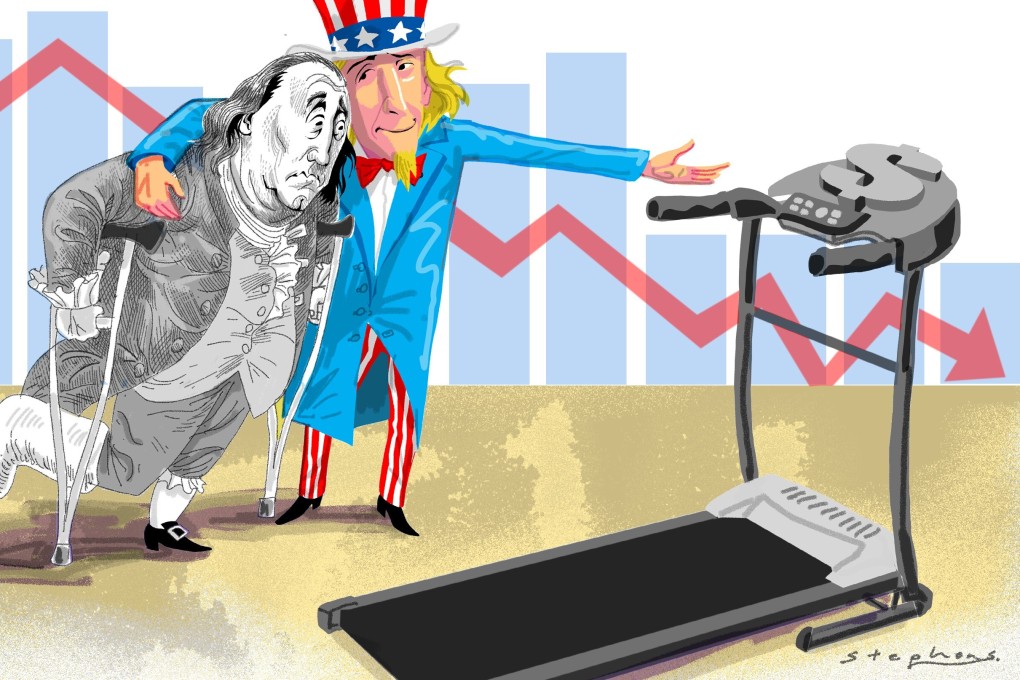

Opinion | Why US hopes for a quick economic recovery from the coronavirus are pure fantasy

- Structural changes to the US economy over the past 50 years mean Covid-19 is no short-term shock to be easily dismissed

- US prosperity is built on debt, and heavily reliant on global demand for advanced goods and consumer demand for frills, none of which is likely to bounce back as quickly as many wish

That is possible: already in May, unemployment figures took a favourable turn, and it is looking like the second-quarter slump may not be as bad as projected. But, even if the budget office is right on both counts, GDP at election time would be 7 percentage points below its first-quarter level, and unemployment would be above – possibly far above – 10 per cent.

Let’s assume that the optimists are right about the third quarter. What happens next? Will the economy continue merrily along, with incomes and jobs bouncing back? Or will it stay in depression, requiring a new revolution – or, more precisely, a new New Deal – to save it?

To assess this question, Furman, Krugman, and the budget office share a mental model. They regard the pandemic as an economic shock, like an earthquake or the September 11 attacks. It is a disruption to a solid structure, a deviation from normal growth. To get America moving again, what is mainly needed is confidence, perhaps aided by stimulus. If consumers channel their pent-up demand into new spending, this “shock-stimulus” model dictates, then businesses will revive investment, and soon enough, all will be well once again.