Advertisement

The View | How socially responsible investing can help end modern slavery

- Investing with a conscience is a growing trend worldwide, but the focus so far has been on environmental and governance issues. Metrics must be established to track social issues, so investors can make a tangible impact

Reading Time:3 minutes

Why you can trust SCMP

Globally, it is estimated that more than 40 million men, women and children are victims of modern slavery today, with 62 per cent in Asia and the Pacific. These victims, who can be found in factories, construction sites and fisheries, are forced to work for little or no pay, deprived of their freedom and often subjected to unimaginable suffering. Many of these victims are associated with manufacturing supply chains, which begin with a grower or producer, and end with a finished product on the retail market.

Advertisement

Despite the best efforts of the United Nations, governments and NGOs around the world, only 0.2 per cent of the victims are helped each year. For the world to really make a difference to this problem, the private sector must get on board.

But modern slavery continues to be a sensitive issue in the private sector. Because it is new and often hard to address in a business context, many companies don’t know how to begin the process of engaging. But with a range of new anti-slavery legislation, more lawsuits against corporations and wider media attention, ignoring this issue is no longer an option.

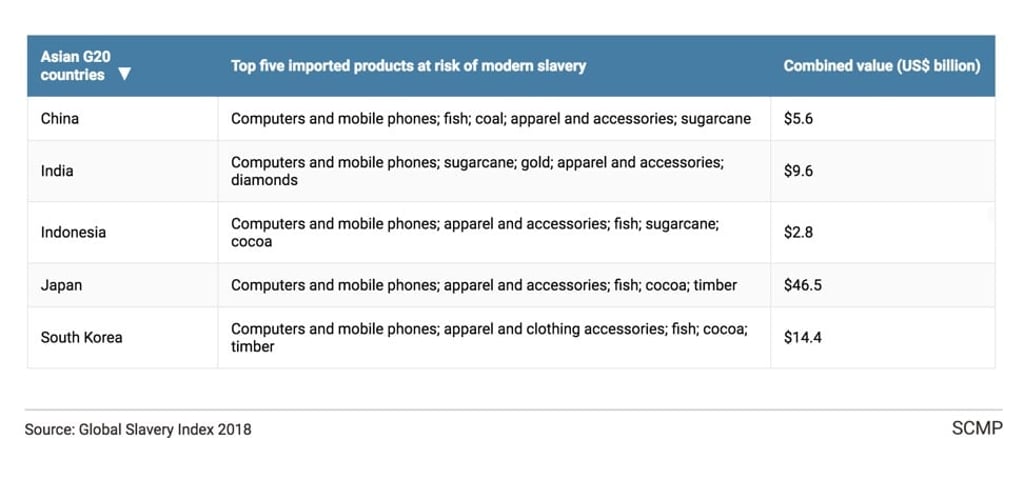

Investors have a key role to play in fighting against modern slavery. Certain goods are more likely to have been produced in conditions of modern slavery, if sourced from certain territories: according to the Global Slavery Index 2018, these include cotton, bricks, garments, sugar cane, gold, carpets, coal, fish, rice, timber, cocoa and electronics. It is essential that investors carefully assess companies in these sectors and have adequate policies and procedures in place to identify and address modern slavery in their supply chains.

Advertisement

In recent years, there has been an increased focus on environmental, social and governance, or ESG, factors in investment decisions. Each stream of ESG data should include indicators of related issues. Environmental data relates to biodiversity, carbon emissions, energy use and water management; Social factors include modern slavery, human rights, diversity, employee relations and occupational health and safety; and governance data relates to board composition, executive compensation, ownership structure and shareholder rights.

Investing with a conscience has grown 17 per cent a year and, today, around US$20 trillion – a quarter of the assets under management worldwide – is invested in accordance with ESG principles. Evidently, sustainable investing can reward companies, shape their policies and positively impact environmental and social issues.

Advertisement