Advertisement

Macroscope | The bull market is a monster the central banks helped create. What can they do now to keep it under control?

- The central banks did such a good job of stimulating the world economy after 2008, they abetted the longest bull market in history

- Now they are stuck, seemingly unable to roll back interest rates without triggering another crash

Reading Time:3 minutes

Why you can trust SCMP

Have we really entered a new age of a perpetual bull market for stocks? The current rally in the S&P 500 is the longest on record, with another high notched up last week. Will the central banks finally spoil the party or will they continue to lead the rally as they have since the darkest days of the 2008 crash? With global monetary policy becoming blurred, investors can probably count on the central banks to extend their blessings a while longer.

Advertisement

It’s a far cry from 1996 when then United States Federal Reserve chair Alan Greenspan railed against overvalued stock markets, warning of the dangers of “irrational exuberance” unduly ramping up asset values relative to risk. These days, it seems just as important for central bankers to keep a keen eye on stock market performance as to do their usual job of helping maintain the best conditions for sustainable, non-inflationary economic growth and job creation.

The central banks did a great job of building the rally out of the debris of the crash, by plying the global economy with endless supplies of easy money, cheap credit and institutional support. This was aimed at rescuing hard-pressed consumers, businesses and financial markets from the brink of disaster, but it ended up providing an unparalleled windfall for global investors, laying the foundation for a 333 per cent rally in the S&P 500 since the post-crash lows 10 years ago.

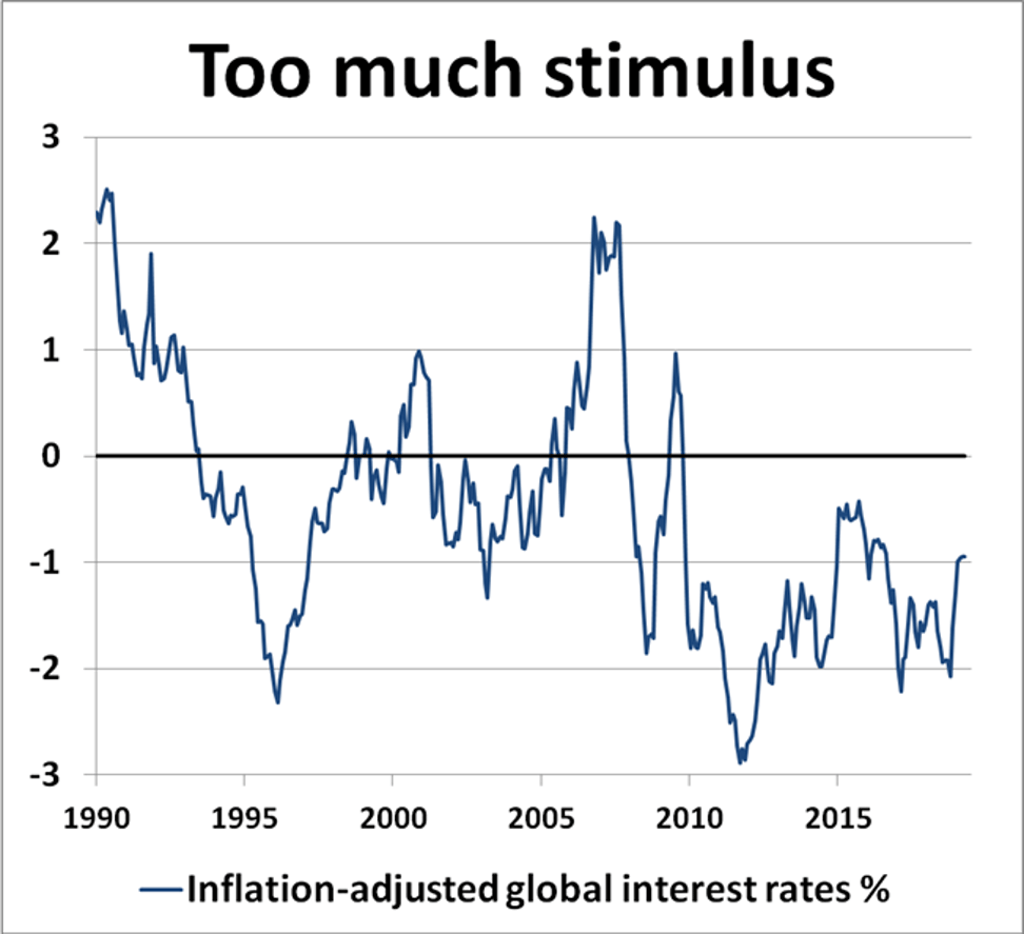

Which begs the question: what should the central banks be doing now? The world economy is back on its feet, with global growth expected at 3.3 per cent this year, according to the International Monetary Fund. Does it still warrant global interest rates running at low, super-stimulus levels? Should robust economic recovery coupled with 2 per cent inflation be the main priority, or is it more important to keep global markets fired up on cheap and easy money?

Advertisement

At a time when prudential monetary management should be the dominant theme, central banks have ended up dancing to the stock market’s tune. Economic, consumer and business confidence is so closely linked to stock market sentiment that policymakers seem reluctant to rock the boat in any way. Investors have become so reliant on the free flow of cheap credit that it will be an uphill struggle to reverse it. In essence, the central banks are aiding and abetting the longest bull market in history.

Advertisement