China shouldn’t count on currency stability to last. Rather, it should take steps to make the yuan a safe haven

- While Beijing may breathe easier now than in 2018, global conditions remain uncertain, meaning China should hasten reforms to strengthen the yuan’s position as a reserve currency, to challenge the dominance of the US dollar

It’s a popular misconception in currency markets that the trend is your friend – investors should know nothing is ever taken for granted. Beijing will be very relieved about the yuan’s relative stability over the past few months, but it is not the end of the matter.

With so much uncertainty in global markets right now, the worry is that it marks the calm before the storm, with a return to last year’s yuan lows near 7.0 against the US dollar not an unreasonable bet. Beijing still has its work cut out strengthening the yuan’s short- and long-term resilience to outside risks.

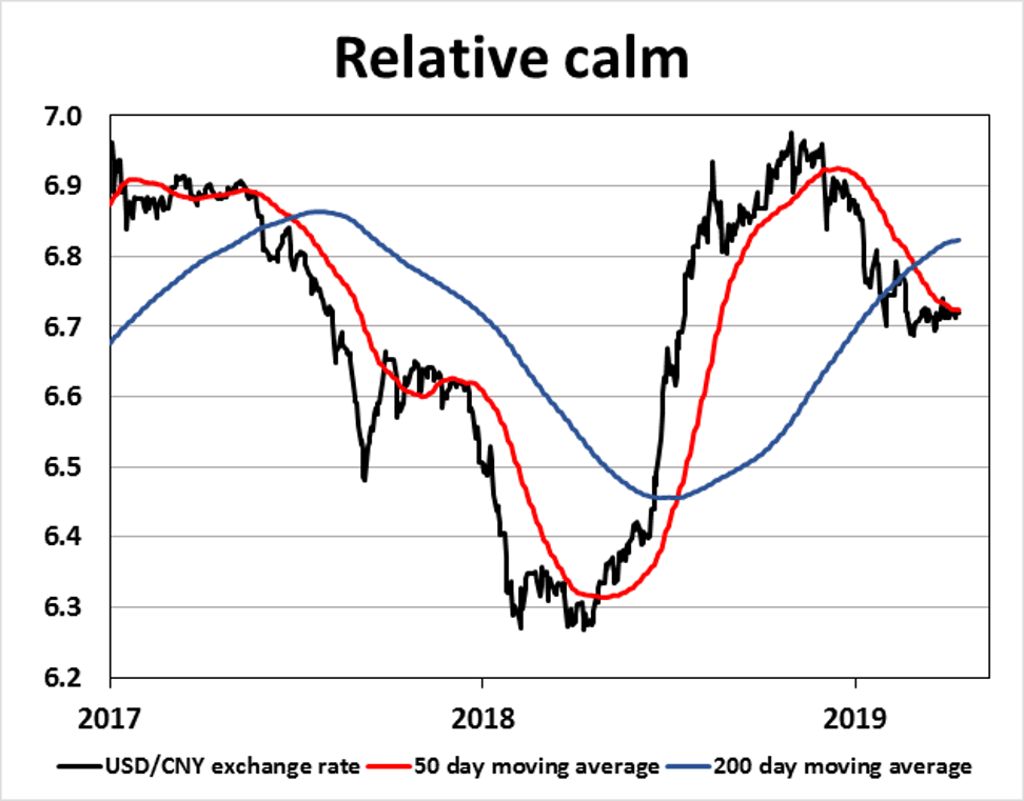

The yuan has enjoyed a good spell of stability lately with the exchange rate moving in a narrow CNY6.68 to CNY6.72 band since mid-February, reassuring after a 10 per cent slide to a CNY6.976 low-point last year. It’s had a calming effect on risk perceptions, with 1-month implied USD/CNY forex volatility easing down to a muted 3 per cent from a 7.5 per cent peak last year.

Forecasters now see little change in the dollar/yuan outlook over the next half a year, with consensus polls expecting CNY6.70 in six months’ time based on Reuters surveys, virtually the same as today’s CNY6.704 rate.