How to privatise Hong Kong’s public housing, and satisfy the desire for homeownership

Richard Wong says people’s aspirations for homeownership can’t be ignored. A plan to let public tenants buy their flats could succeed if the prospective owner has a realistic chance of paying off the loan, and is able to reap the full capital appreciation of the property

Hong Kong’s public housing policy was devised in the 1970s when the main housing problem was overcrowding in the private rental sector. Many of the tenants had very low incomes and it made sense for policymakers to focus on affordable low-rent flats.

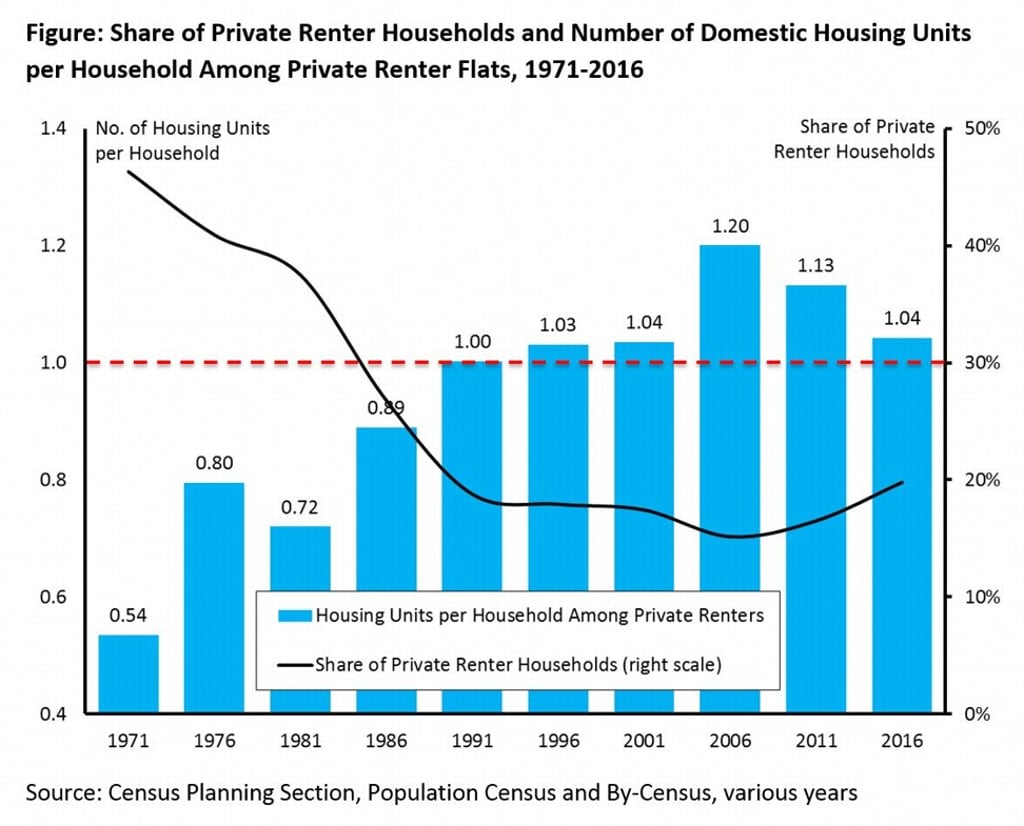

By the 1990s, however, the situation had changed completely. The number of units per household among private renters had increased from 0.54 in 1971 to 1 in 1991. Overcrowding had mostly been eliminated and improved economic conditions had increased the attractiveness of homeownership.

Unfortunately, the original public housing strategy did not change under these new circumstances. There was no systematic review to reprioritise it from a tenancy-based model to an ownership-based one – with the possible exception of the ill-fated and flawed Tenants Purchase Scheme, which was launched in 1998 and discontinued eight years later.

Today, as private home prices continue to rise, a shortage of affordable private rental housing has led to the mushrooming of subdivided units. As a result, more households are opting for the more spacious and more affordable public rental flats.