Advertisement

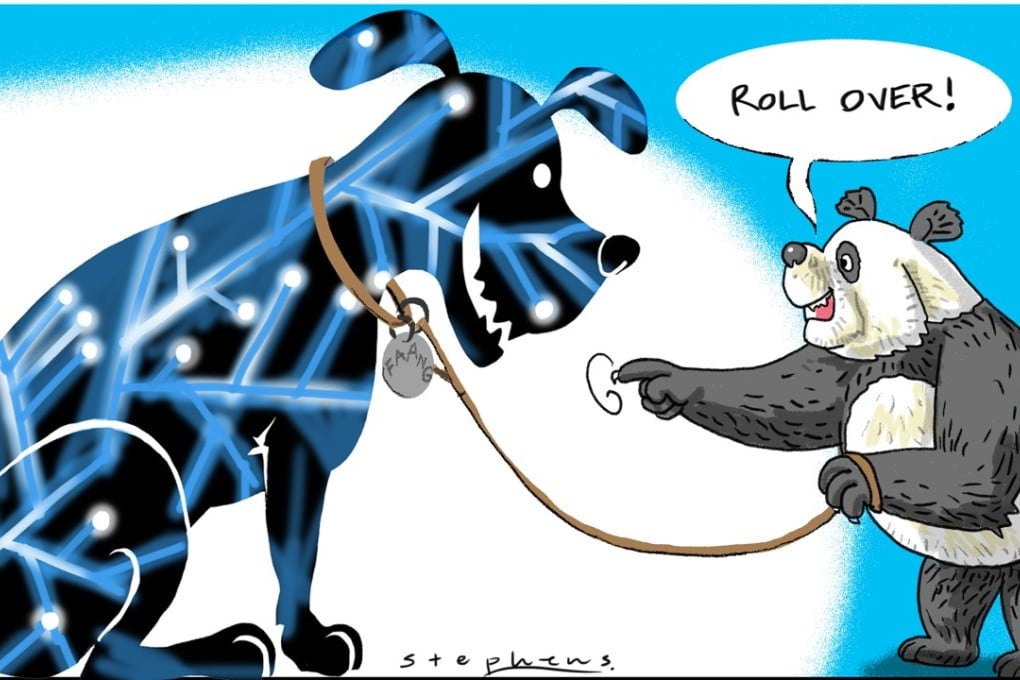

China vs Google, Facebook and other US internet giants: a lesson in internet oversight for the West

Jesse Friedlander says while the US government is playing catch-up with the globally powerful tech companies of Facebook, Google and others, Beijing’s tight grip on cyberspace appears to be paying off

Reading Time:3 minutes

Why you can trust SCMP

0

Watching US technology leaders try to curry favour at China’s premier internet conference is instructive of the quickly shifting power dynamics among global tech giants. China is the only major market where Silicon Valley’s greatest companies have yet to gain a foothold. Famous for their “take no prisoners” aggressiveness and willingness to break the rules, the leaders of these companies on this occasion, in Wuzhen, Zhejiang, displayed modesty and submission to authority.

At the back of everyone’s mind must be Uber, which, despite its first-mover advantage, was forced to beat a retreat last year after losing billions trying to establish its business in China.

California’s Silicon Valley has long been home to libertarian technologists, who place their faith in the ability of unfettered innovation to solve real human and business problems. Largely free from government regulation, these brainy optimists have developed ideas that have radically changed the way people work, communicate, shop and learn. In the process, they have disrupted – or eliminated – countless companies that relied on traditional approaches to providing goods and services.

Today, the most prominent examples of Silicon success stories are the vaunted “FAANG” stocks, an acronym for Facebook, Apple, Amazon, Netflix and Google. Individually, each of these companies dominates its market segment in the United States and in most international markets.

For example, Facebook is the world’s largest social media company with over two billion active users. Together with Google, the two giants account for 84 per cent of global digital advertising spending. Amazon has 44 per cent of e-commerce sales in the US. Altogether, “FAANG” has a market capitalisation in excess of US$2.5 trillion, which surpasses that of France, the world’s seventh-largest economy.

Advertisement