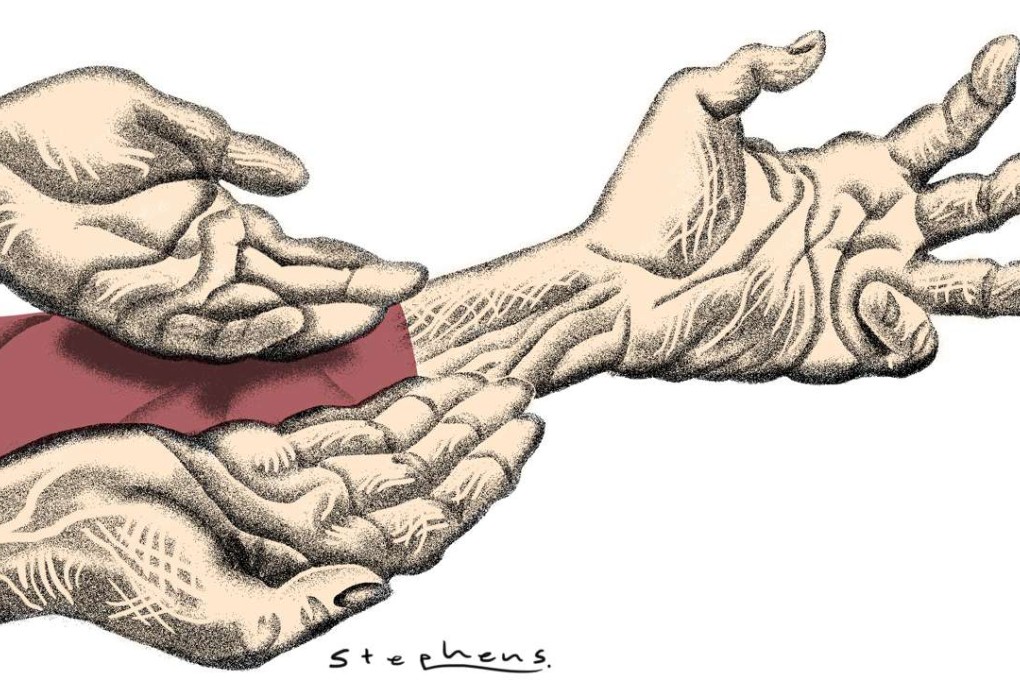

To start with, Hong Kong people must agree that some pension protection is better than none

Gary Wong says though ideal, a universal retirement protection plan cannot be rushed through, and if no consensus is reached, we must begin with a need-based scheme

Retirement protection has received a lot of attention, yet no consensus is in sight. Given our ageing population, a shrinking labour force and a bleak outlook for the economy, the challenge is to find a viable universal retirement protection scheme.

Why a one-size-fits-all pension scheme won’t work in Hong Kong

Those who have contributed to society should be able to enjoy their old age. But the reality is different. In Hong Kong, an elderly person who is single and who has less than HK$45,500 in assets may apply to receive HK$5,100 from the government each month. However, only 40 per cent of eligible seniors actually claim this subsidy. Single elderly people with assets of more than HK$210,000 can claim HK$2,390 from the government each month. This amount is not enough to cover all retirement expenditure. Longevity then becomes a burden to them.

A universal pension scheme is a right, not welfare. And discussion should focus on how society may implement a universal scheme without having the government go broke.

I can’t please all: Hong Kong chief secretary comments on the controversial consultation on retirement protection

Not long ago, 180 scholars published a joint suggestion on retirement protection. Their “three-pronged funding model” uses a partially pre-funded system instead of a “pay as you go” system. In this case, the government would inject a HK$100 billion pension fund and corporates that have annual profits of more than HK$10 million would pay an extra 1.9 per cent of profit tax. Meanwhile, employees and employers would have to contribute a total of 5 per cent of the employee’s basic salary.

The goal of this proposed scheme is to give each elder aged 65 or above a fixed monthly pension of HK$3,500 (by 2016 standards). This payment is expected to replace existing government subsidies. The amount of future payments will be adjusted for inflation. The scholars predict that there will still be a HK$160 billion government surplus by 2064.

HK heading for unwanted options on working hours and retirement

This proposal has its appeal. But it makes assumptions that need to be explored. First, the scheme assumes that the annual real rate of return of pension funds is 2 per cent. Thus, if inflation stands at 2 per cent, the return on investment has to reach 4 per cent. If one looks at the Exchange Fund, its return on investment in 2014 was only 1.4 per cent. The 2015 figure, meanwhile, was a negative 0.6 per cent. How can the government ever make sure that the return from the government retirement protection scheme can stay at 2 per cent per annum in real terms?