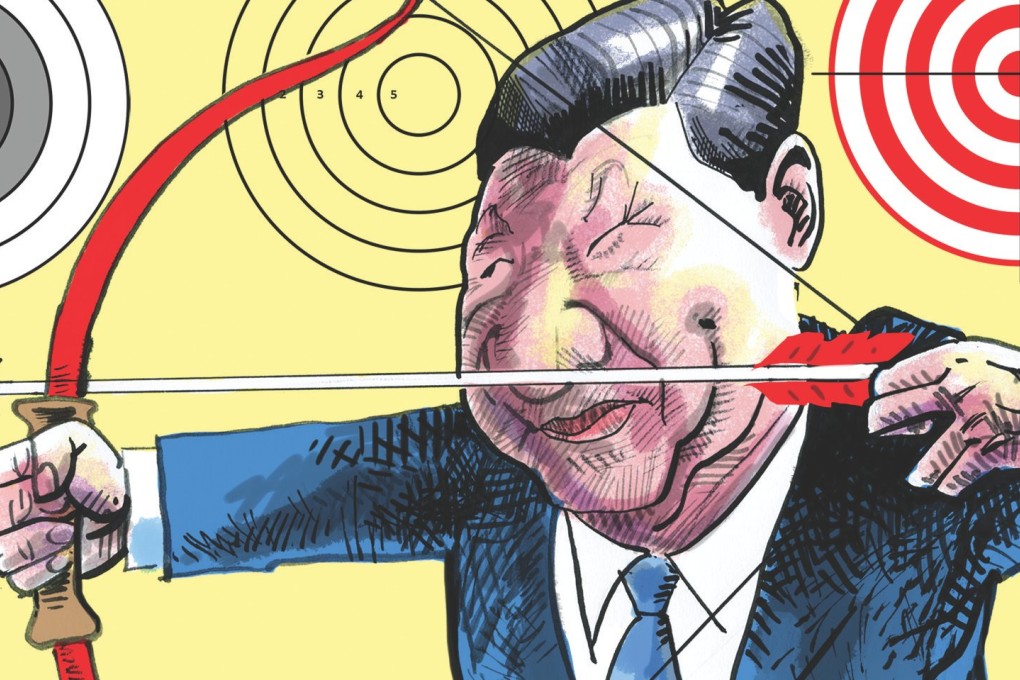

Five issues China must address in its latest five-year plan

Francis T. Lui says China's five-year plan must address the salient issues of its structural transformation

The Central Committee of the Chinese Communist Party meets this week for the 5th plenum of its 18th National Congress. The main item on the agenda is to discuss and approve the 13th five-year plan, which will span from 2016 to 2020. In a globalising world shaped by powerful market forces, are national five-year plans typical of command economies still relevant?

Five-year plans set up targets, many of which often turn out to be grossly inaccurate. The worst one for China was the 2nd five-year plan of 1958-1962, where none of the multiple targets were met. The 6th (1981-85) and the 8th (1991-95) plans were also way off-target. Gross domestic product growth target for the former was 4 per cent per annum, but it finished up at 11 per cent instead. The average growth rate of 11.6 per cent from 1991 to 1995 also deviated wildly from the original target of 6 per cent.

If Hong Kong wants to benefit more from the five-year plan, it has to uphold its own entrepreneurial spirit and come up with innovative adjustments itself

China's central government, powerful as it is, does not possess the capacity to dictate how the economy performs.

This year is the last of the 12th five-year plan period. Despite all the worries about the slowdown of the Chinese economy, the planned target of 7.5 per cent GDP growth will certainly be fulfilled. During the first four years of the plan period, average GDP growth per year was 8.04 per cent. Even if the growth rate this year drops to 6.8 per cent, the economy will still enjoy an average growth rate of 7.79 per cent over the five years.

Twenty or thirty years ago, few people in other parts of the world would pay attention to any of China's plans. Things have changed. Observers around the world now have to figure out what new economic policies will be undertaken in China. It was the focus of attention at the IMF conference held in Lima earlier this month. The International Monetary Fund's chief economist, Maurice Obstfeld, pointed out that the global economy was at the intersection of three powerful forces, China's economic transformation, the related fall in commodity prices, and the impending normalisation of monetary policy in the United States.