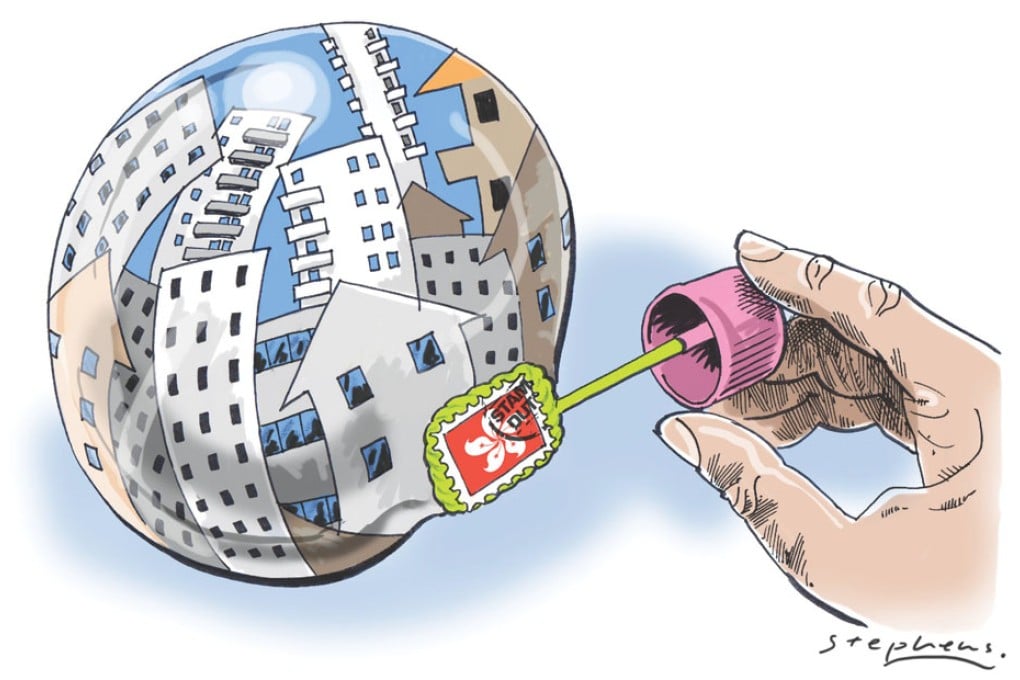

Drastic measures necessary to stabilise Hong Kong property market

Anthony Cheung says the government's drastic measures to curb property speculation and stabilise prices are needed in these exceptional times to avoid the risk of a massive bubble

The Legislative Council will resume the second reading of the Stamp Duty (Amendment) Bill on Wednesday. The bill, if passed, will end the extended period of uncertainty in the market over the demand management measures introduced by the government in October 2012 - namely, an enhanced special stamp duty to curb short-term speculation and a new buyer's stamp duty to raise transaction costs for everyone except Hong Kong permanent residents.

The additional measure introduced by the government in February last year, namely the doubling of ad valorem stamp duty for all property transactions, whether residential or non-residential, is under scrutiny by another Legco bills committee.

These demand management measures are not introduced casually. They are extraordinary measures to cope with exceptional circumstances. Before the 2012 measures were announced, residential property prices had increased by 24 per cent just between January and October that year, doubling the 2008 level.

After the announcement of the measures, prices moderated, but only for a while before soaring again. During January and February last year, residential property prices increased by a monthly average of 2.7 per cent.

Meanwhile, non-residential property prices similarly spiralled upwards - prices of retail, office and flatted factory space surged by 39 per cent, 23 per cent and 44 per cent respectively in 2012. In the face of the undue market exuberance, the government had to intervene again, by way of last February's doubling of the ad valorem stamp duty. The Monetary Authority also imposed new requirements on mortgage borrowing to send a clear signal to the banks that they must be cautious in their lending.

Since then, the market has gradually stabilised. From March last year to January this year, housing prices by and large stayed calm, recording an average monthly increase of only 0.2 per cent. As of now, sentiments remain volatile but the public clearly recognises our determination to maintain stability in the property market.