Physical ETFs trailing their synthetic peers

A cheaper and more transparent way to buy China stocks - it's just a shame about the tax

Physically backed A-share exchange-traded funds were the biggest innovation in the local funds market last year. The fund improved access to mainland-listed stocks. In particular, providers said they were cheaper and safer than synthetic A-share ETFs, which use derivatives.

So now that the physical funds have been trading for about eight months, it is a good time to assess their performance. The A-share market has risen about 8 per cent since the first physical ETF rolled out in July. Hongkongers are buying mainland equities again, and ETFs are effectively the only way into this market.

There are four physical A-share ETFs trading in Hong Kong with a quota to invest a combined 43 billion yuan (HK$53 billion). Physical A-share ETFs are a fixed feature of this market and you will likely be soon asked to buy one at your local bank.

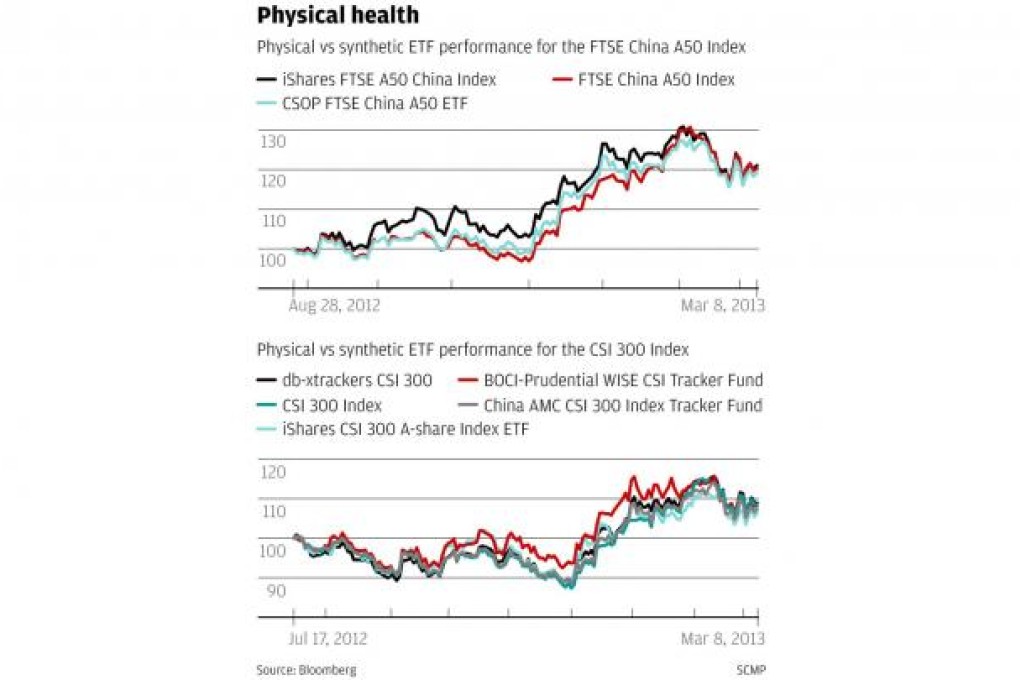

In the charts below, we look at the trading performance of physical ETFs compared with the benchmark they track and the synthetic funds linked to the same index.

The charts show the physical funds trailing their synthetic peers, albeit fractionally. The top chart for example shows the CSOP FTSE China A50 ETF (a physical fund) underperforming the iShares FTSE A50 China Index (a synthetic fund) since its launch in August last year. Likewise, in the bottom chart, the China AMC CSI 300 Index Tracker Fund (physical) trails its index and two synthetic funds which track the same benchmark.