Election 2020: Wall Street prepares trading systems for spikes in election night financial transactions

- Trading volumes are likely to spike to as much as eight times their normal levels on November 3, according to technology-consulting firm ITRS Group

- That forecast and a spread-out workforce has the biggest banks testing their technology to make sure they can handle the extra flow

On Wall Street, it’s considered a rite of passage to spend election night at your desk, teeing up orders and making trades until the wee hours. This year could be even wilder than normal, though many will be experiencing it from home.

With a tight race and President Donald Trump already questioning any outcome that doesn’t have him defeating rival Joe Biden, trading volumes are likely to spike to as much as eight times their normal levels on November 3, according to technology-consulting firm ITRS Group. That forecast and a spread-out workforce has the biggest banks testing their technology to make sure they can handle the extra flow.

Financial firms are telling staff and clients that this year will be different. With coronavirus-fearful voters relying on mail-in ballots, and the US Postal Service already beleaguered by delivery problems, election results could be delayed by days or longer.

Trump said this week he wouldn’t commit to a peaceful transfer of power if a tally of ballots shows Biden winning. Senate Majority Leader Mitch McConnell, meanwhile, pledged an orderly transition.

11:15

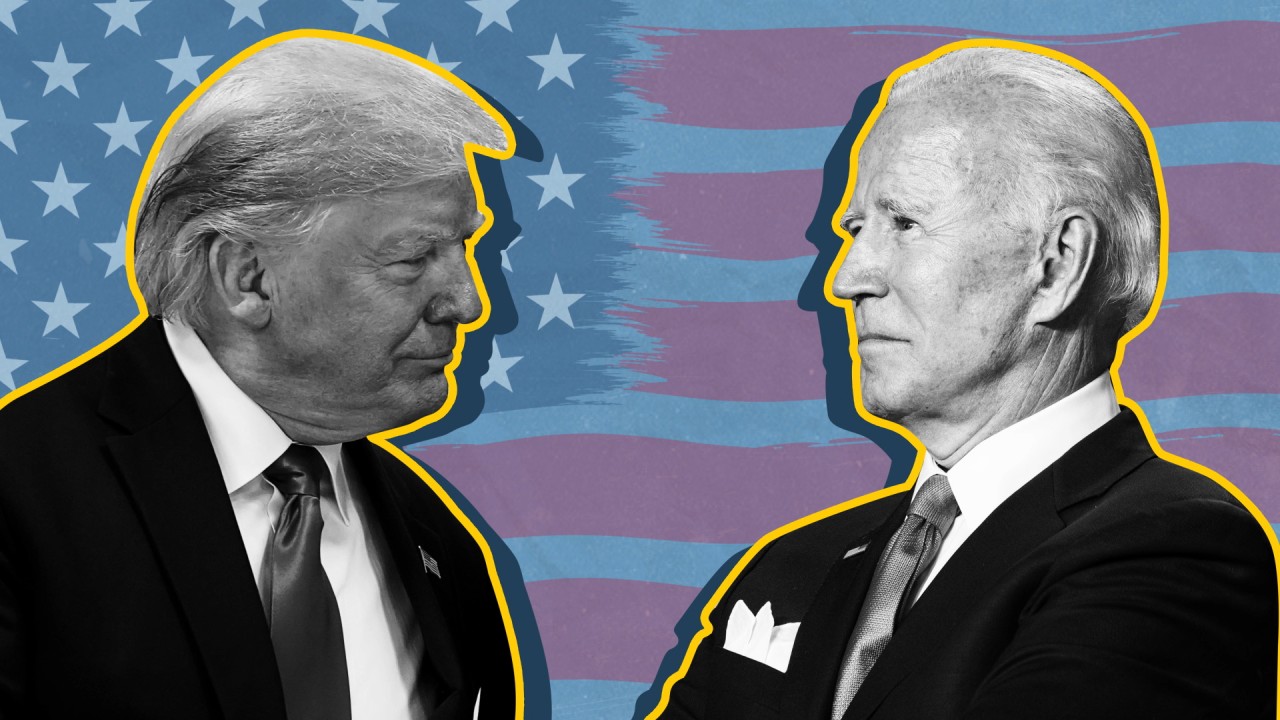

Trump vs Biden: The 2020 US presidential election