Goldman Sachs lists at least seven hurdles to a 20 per cent upside in China’s battered stocks amid market turbulence

- Goldman Sachs sees the MSCI China Index rising to 84 points by March next year from current level with a pick of 50 policy-boosting plays

- Investor conviction has waned due to zero-Covid policy, fanning downgrades in economic growth, corporate earnings and market ratings in some cases

Demand for diversification from China-mandated investors, slowing economic growth and corporate earnings, lack of forceful policy easing, disillusioned foreign funds, and underlying geopolitical risks are some of the reasons its buy recommendation since late last year has not quite paid off.

“The strategic case remains intact, but [we] acknowledge that assessing the case has become more complicated,” strategists including Kinger Lau said in a report on June 2. “Demand for diversification among China-mandated investors has risen” as risks to the economy and market are amplified with Covid-induced lockdowns.

While the so-called ‘China Put’ or policy backstop has been activated as top Beijing officials refocus on reviving growth, more aggressive measures are needed to restore consumer and corporate confidence, they wrote. Besides, consensus forecasts on earnings “are still too optimistic and more downgrades are likely”, they added.

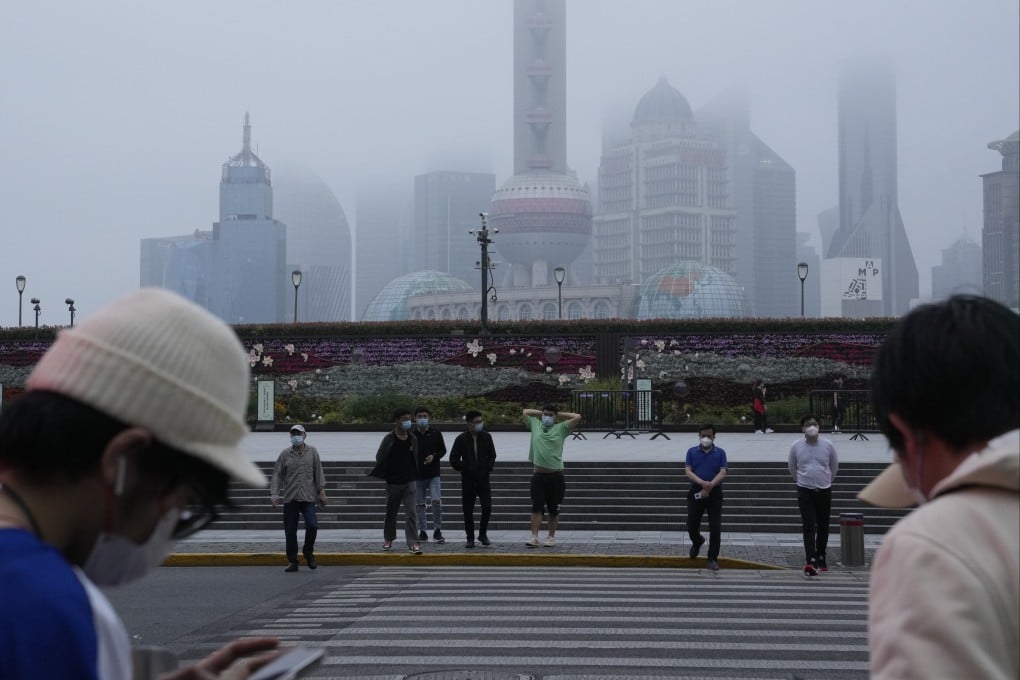

The challenges underscores why foreign investors have taken a patient stance before committing more money to the market. China’s zero-Covid policy has triggered lockdowns in 40-odd mainland cities this year, reducing the economy to an unpredictable stop-start pattern while clouding earnings outlook.

“We expect the strength of any potential rebound of the Chinese economy to be moderate in the absence of any meaningful changes in the Covid policies and more decisive stimulus measures,” Pictet Wealth Management said in a May 24 report. “China’s recovery is likely to be slow and limited.”