Hong Kong’s regulators consider taking some sizzle out of world’s hottest IPO market, cracking down on China’s debut punters

- The HKEX aims to pick out investors who use different brokerage accounts to apply for the same IPO, when it rolls out its Fast Interface for New Issuance (Fini) system in the second quarter of 2022

- The Securities and Futures Commission (SFC) proposed to set up an investor identification system to augment its market surveillance function and detect possible misconduct

“If Hong Kong implements the investor identification rule, then no one can submit multiple IPO applications,” said Tom Chan Pak-lam, chairman of the Institute of Securities Dealers, an industry guild for more than 600 licensed stockbrokers in Hong Kong. “The proposal would have a big impact to the market, which will be controversial.”

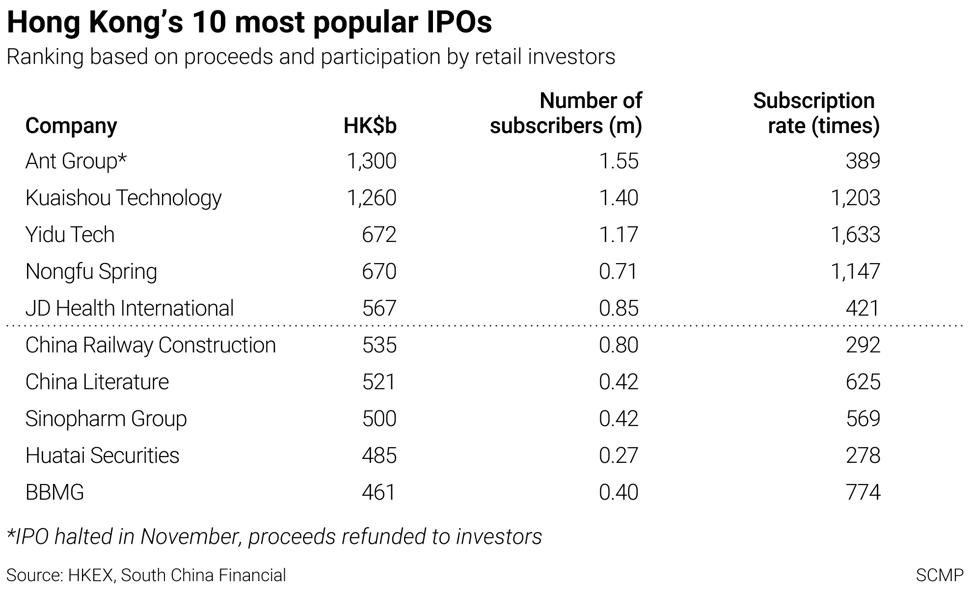

Hong Kong was the world’s top IPO destination in seven of the previous 12 years, with last year’s tally standing at a record HK$398 billion involving 154 companies raising capital in the city. That included nine secondary listings by US-listed Chinese companies that raised HK$131.3 billion. Between 120 and 130 listings are in the works this year, aiming to raise HK$400 billion, according to Deloitte’s forecast.

David Zheng, who works at a Guangzhou bank, is one such IPO speculator. His profit from subscribing to IPOs last year were equivalent to a fifth of the annual salary of his day job, he said.

“I jumped on the bandwagon because many Chinese tech giants are turning to Hong Kong as a secondary listing venue [after US tightened listing rules],” Zheng said, adding that his key to success was to flip his IPO shares on debut day. “Many mainlanders around me are now trying to find ways to open securities accounts to trade stocks in Hong Kong.”

A Hong Kong bank account remains the prerequisite for trading directly on Hong Kong’s stock market, even as China’s currency regulator said a plan is under way to let individual investors buy overseas financial assets.

Chinese depositors are allowed to open bank accounts in Hong Kong from mainland China, subject to extremely high minimum deposits that run in the millions of yuan. Some Hong Kong brokers claim they can help their mainland clients open accounts in the city with different banks, with lower minimum deposits than the official thresholds.

On China’s ubiquitous WeChat social media network, dozens of chat groups abound that offer tips and proffering services to help Chinese retail investors tap Hong Kong’s IPO market. On one such chat, a user identified only as Zhang advised users to gather different identity cards to make multiple subscriptions in Hong Kong’s IPOs, adding that he had earned “millions of yuan” in the past few years.

One broker, speaking on condition of anonymity, claimed that he can open an HSBC bank account in Hong Kong, with the prospective customer depositing HK$50,000 for a month at branches in Beijing, Nanjing, Wuhan or Suzhou. The agents charge a 4,000 yuan fee for helping to open accounts in Hong Kong.

Another broker claimed that such accounts are possible via Minsheng Bank for customers working at internet companies listed in the US or Hong Kong. A 50,000-yuan three-month deposit at a Minsheng Bank branch on the mainland leads to an account in Hong Kong. For customers who are not on the list of favoured companies need to deposit 300,000 yuan for six months before they qualify, agents said.

The alleged practices, which violate regulations on the mainland and in Hong Kong, cannot be independently verified.

“Customers who are interested in HSBC services should always approach the bank directly to avoid falling into potential fraud schemes,” said a bank spokesperson in Hong Kong, emphasising that the bank does not allow third parties to help customers open bank accounts.

Hong Kong’s brokers currently supply identification codes comprising up to nine characters, or their customers’ securities accounts, in IPO subscriptions.

Those codes, which can be matched with the city’s eight-character identity cards but not with China’s 18-character identity cards, provide the cloak under which mainland China’s stock punters hide. An HKEX spokeswoman declined to comment.

To be sure, multiple applications for IPOs constitute criminal offences. Four people were sentenced to nine months in prison in 2009 for using false identity cards and addresses in making multiple applications for the 2006 IPO of the Industrial and Commercial Bank of China (ICBC). They made a combined profit of about HK$270,000 through their scheme.

“This is a serious financial crime,” Deputy Judge Eddie Yip Chor-man said while delivering his sentence at the time. The defendants’ actions “have broken the rule that one investor should only apply once in an initial public offering. Their actions have affected the chance for other investors to subscribe to the new shares and have hurt the integrity of Hong Kong’s investment market,” the judge said.

But ultimately, it may be a simple matter of demand exceeding supply, said Christopher Cheung Wah-fung, who represents Hong Kong’s financial services industry in the city’s legislature.

“Why do investors break the law to apply multiple times for IPOs? It is because the chance for them to get an allotment is too small,” said Cheung, who is also chief executive of his own brokerage firm Christfund Securities. “If they can get a better chance to get the allotment of the new shares, they will not do the multiple application.”