Advertisement

Goldman ventures where others fear to tread, snapping up Chinese developers’ high-yield bonds, side stepping contagion risk

- Goldman Sachs Asset Management has added a ‘modest amount of risk’ through dollar-denominated high-yield bonds by China property developers

- Goldman also added yuan-denominated Chinese sovereign bonds to its investments in what it described as a ‘risk-off’ trade

Reading Time:2 minutes

Why you can trust SCMP

0

Goldman Sachs Asset Management is buying one of the world’s most distressed assets – Chinese real estate debt – even as other investors shy away.

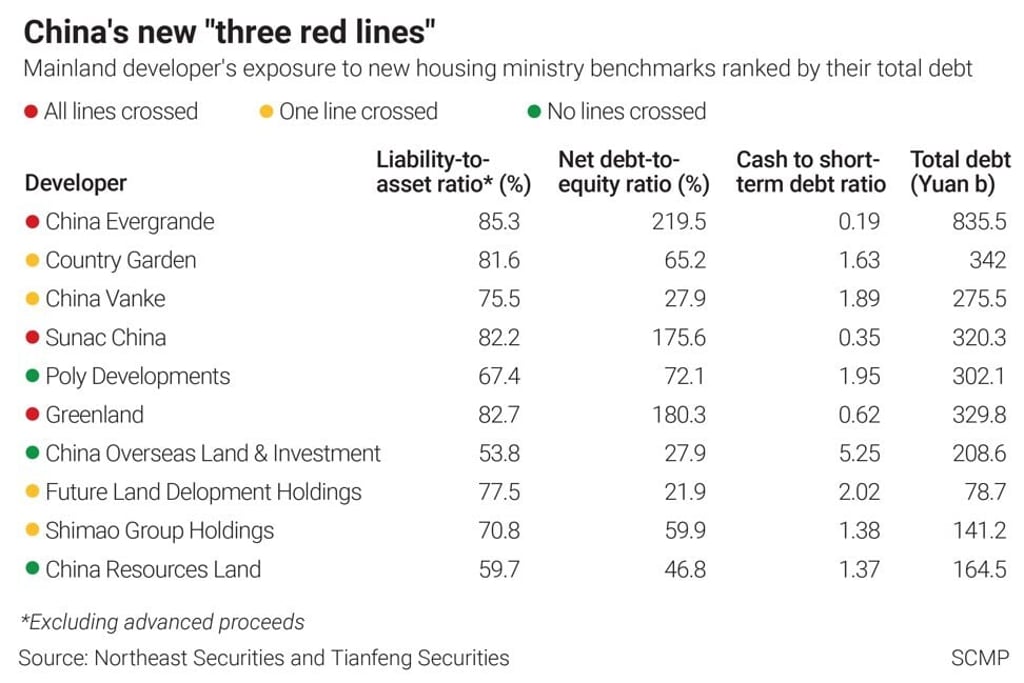

The firm has been adding a “modest amount of risk” through high-yield bonds issued by China property developers and denominated in US dollars, said Angus Bell, a member of Goldman’s portfolio management team. The debt has sold sharply over the last two months as China Evergrande Group, the world’s most indebted developer, moved closer to a potential default that could spread to the rest of the real estate sector.

However, the market is overestimating the contagion risk, Bell said in an interview Friday. And that creates opportunities.

“Ultimately the property sector has been the key driver of Chinese growth over the past two decades,” he said. “It’s unlikely the government will tolerate the impact on growth that would come about if it were to allow such a large number of developers to fail. The breadth of distress that the market is now pricing, it’s starting to look significantly out of alignment with the true extent of distress.”

A Bloomberg index of Chinese junk-rated dollar bonds has fallen 22 per cent since the beginning of September while yields have soared, as the government reined in the property sector and a debt crisis at Evergrande deepened. Senior government officials have stressed that risks in the property market are controllable, and they’re loosening restrictions on home loans at some of the largest banks.

Advertisement