Chinese developers’ overseas spending spree dries up as Beijing tightens screws to restore order at home

- Chinese developers’ overseas investments fell to US$1.9 billion this year versus a record high of US$17.5 billion in 2017, according to Real Capital Analytics

- Despite pressure from regulators companies like Guangzhou R&F Properties and Greenland Holdings continue to invest in the UK and Australia, respectively

Their overseas investments have fallen to about US$1.9 billion so far this year, from a peak of US$17.5 billion in 2017, when they snapped up development sites, offices, industrial, retail, residential, hotel and senior housing and care projects in the US, UK and other parts of the world, according to data from Real Capital Analytics.

“With the capital outflow controls still in place, it is expected Chinese developers’ investment in overseas markets will remain low in the coming years,” said Martin Wong, director and head of research and consultancy for Greater China at Knight Frank. “The ‘three red lines’ policy has been forcing mainland developers to deleverage and slow down their overall pace of expansion.”

Chinese developers will devote more resources in the mainland and Hong Kong rather than overseas destinations, he added.

08:08

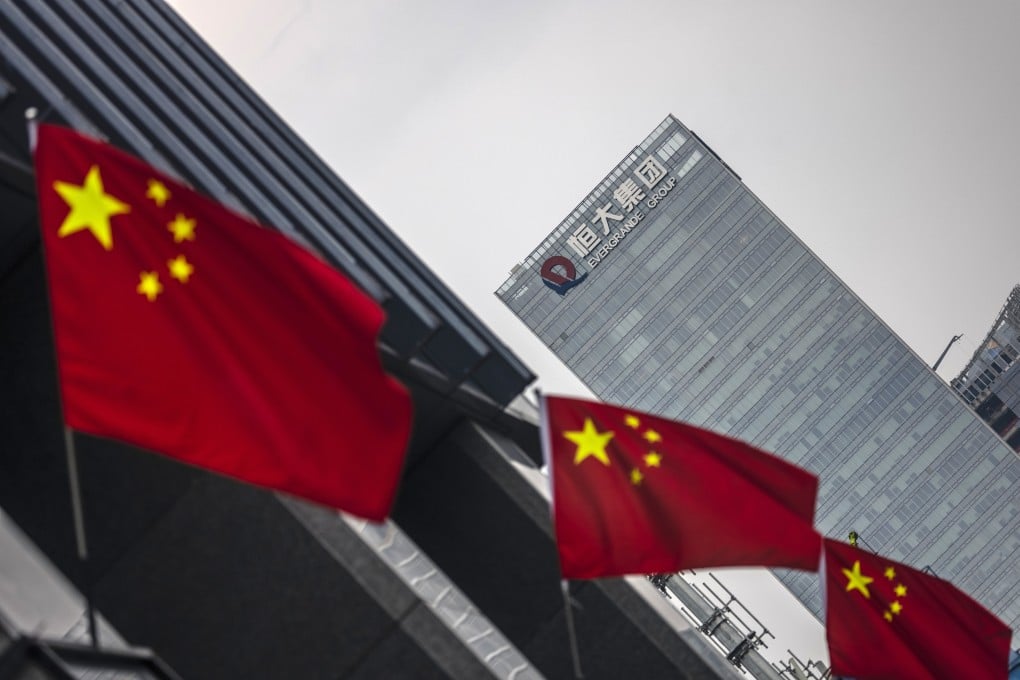

Evergrande debt crisis: How likely is it that bondholders can recoup their investments?