Climate change: investors with US$8.8 trillion of assets lean on CLP, Tenaga, Asian utilities to come clean on carbon emission cuts

- Five power generators including CLP, China Resources Power and Tenaga Nasional are initial targets of a shareholders engagement programme

- New investor group backed by 13 money managers overseeing US$8.8 trillion of assets globally

The other three utilities are Tenaga Nasional in Malaysia, and Chubu Electric Power and Electric Power Development in Japan, according to the Asia Investor Group on Climate Change, the coordinator of the programme.

03:27

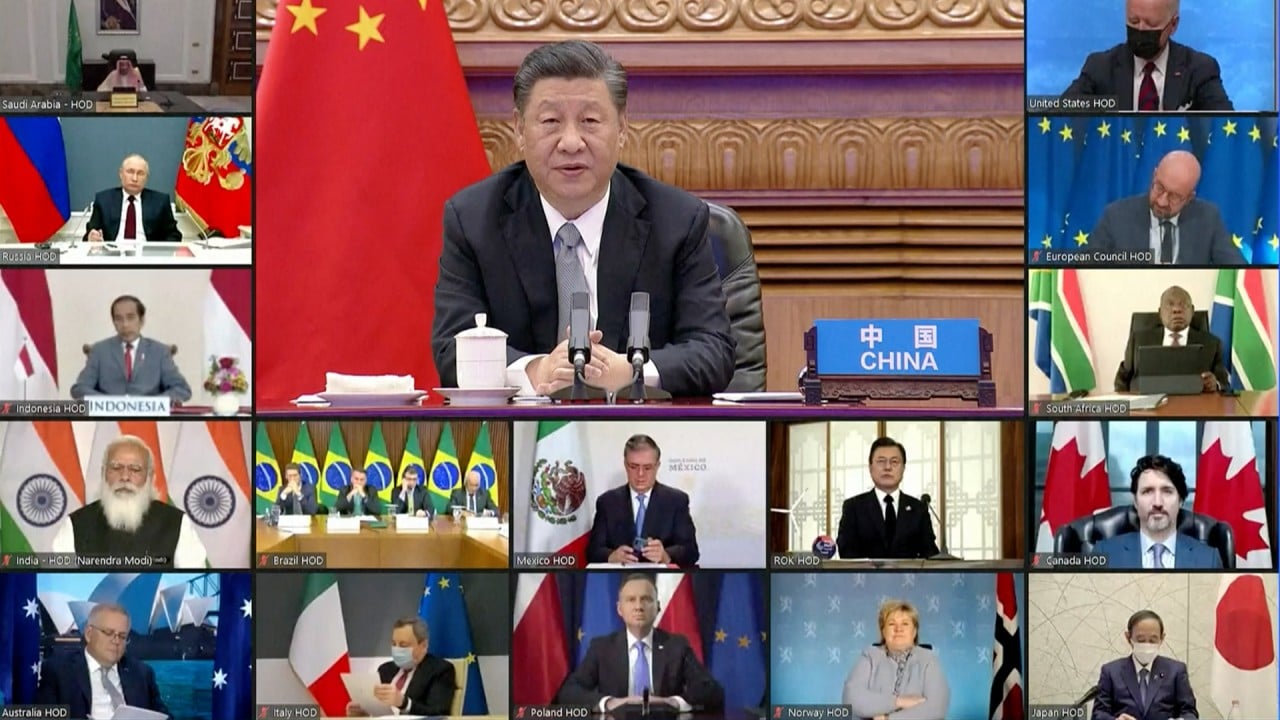

World leaders pledge to cut greenhouse emissions at virtual Earth Day summit

Asia’s power sector contributes about 23 per cent of global greenhouse gas emissions and has a young asset age profile of 13 years versus an average economic lifetime of 40 years, the group said. The five Asian utilities alone emitted 285 million tonnes of carbon dioxide in 2019, roughly the same amount generated in Spain, it added.

The group joins other global coalitions pressuring power-generation firms to protect the earth from hazardous pollutants and halt global warming. Climate Action 100+, a coalition backed by more than 570 investors managing US$54 trillion, has targeted Korea Electric Power, NTPC in India and Hong Kong-based Power Assets Holdings for similar engagement.