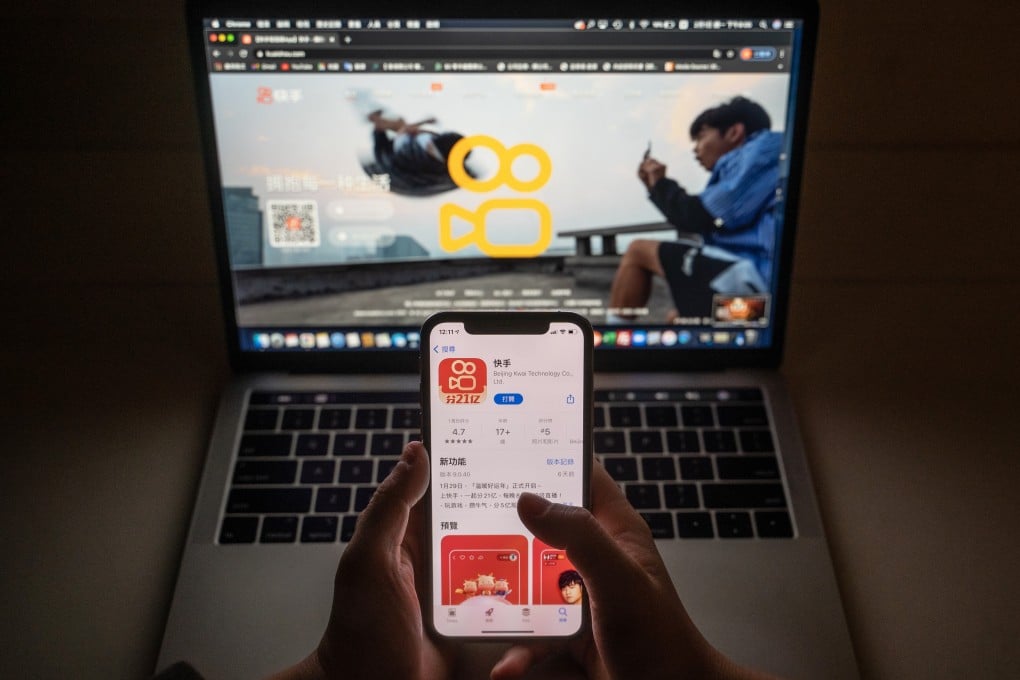

Kuaishou seen rallying 170 per cent in Hong Kong IPO windfall that Ant Group failed to deliver for retail investors

- Stock was recently indicated at HK$310.60 to HK$322 in grey market, according to data published by two local brokerages

- Chinese short-video app operator is the city’s hottest IPO ever by the 1,204 times subscription ratio in local retail offering

Hong Kong retail investors who have poured in HK$1.28 trillion (US$164.8 billion) to bid for a stake in Kuaishou Technology stand to reap a windfall in the city’s most overbought initial public offering on record, judging by pre-trading prices.

The Chinese short-video app operator is expected to fetch more than HK$300 per share, according to pre-trading grey market prices. The stock was indicated at HK$310.60 at 5.13pm local time on Thursday, according to data published by Phillip Securities, and HK$322 at 5.42pm by Bright Smart Securities. They represent at least 170 per cent upside over its HK$115 offer price.

“This [Kuaishou IPO] is the talk of the town,” said Louis Tse Ming-kwong, managing director of Wealthy Securities. “Everyone wants to make a killing on this one, especially before the Lunar New Year.

Beijing-based Kuaishou, or “quick hands” in Chinese, sold 21.9 million shares to local retail investors, drawing subscriptions of 1,204 times what was on offer. Institutional investors including cornerstone buyers took 343.3 million shares. They generated a combined HK$41.3 billion of net proceeds for the company.

The reception turned Kuaishou into Hong Kong’s most popular IPO ever, surpassing the record held by Nongfu Spring. The Chinese water-bottling company’s retail offering in September was 1,147 times covered and its stock has since skyrocketed, turning its founder Zhong Shanshan into China’s richest tycoon.