China’s US$1 trillion sovereign wealth fund sets up special team to divest stakes in soured assets

- China Investment Corp has set up a special team led by managing director Benjamin Bao to tackle growing pile of troubled investments

- Some of CIC’s failed investments include Noble Group, Teck Resources and Chesapeake Energy

China’s US$1 trillion sovereign wealth fund is moving to tackle a growing pile of troubled investments such as its stake in embattled commodity trader Noble Group Holdings, even as the coronavirus pandemic makes any asset sales more difficult.

The disposal of distressed assets is part of CIC’s “normal investment management activities”, the company said in an emailed statement. CIC sticks to its principles as a professional, market-based investor and “tries its best to protect the company’s commercial interests in every aspect of investment management”, it said in the statement.

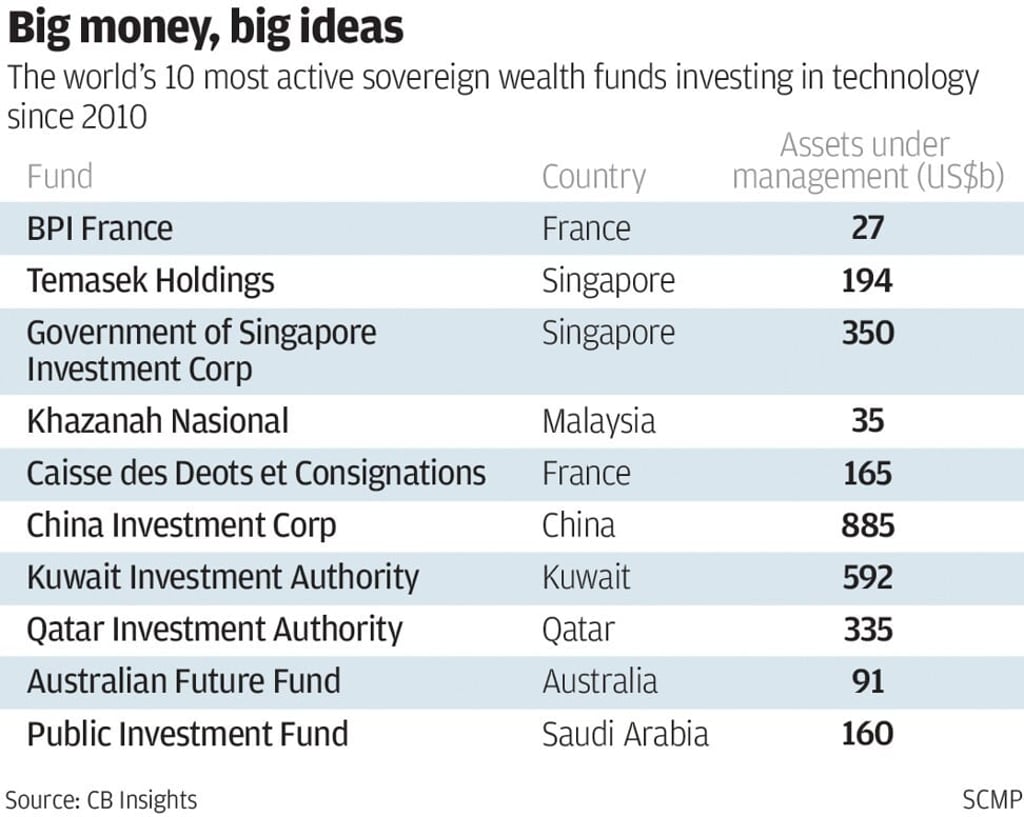

With the global recovery already slowing and other sovereign wealth funds dumping fossil-fuel assets in a push for more responsible investing, the prospects of recovery in the soured assets are dimming further, the people said. CIC last year “took robust action to dispose of distressed assets”, it said in its annual report released last month, without providing details.

It remains unclear what measures could be used to recoup value from the troubled assets besides selling. While CIC has not assembled a special team for distressed assets before, it’s not the first time the company disposed of large positions. In 2014, the public equities department’s proprietary team liquidated more than 20 positions in two months, mostly through block trades.