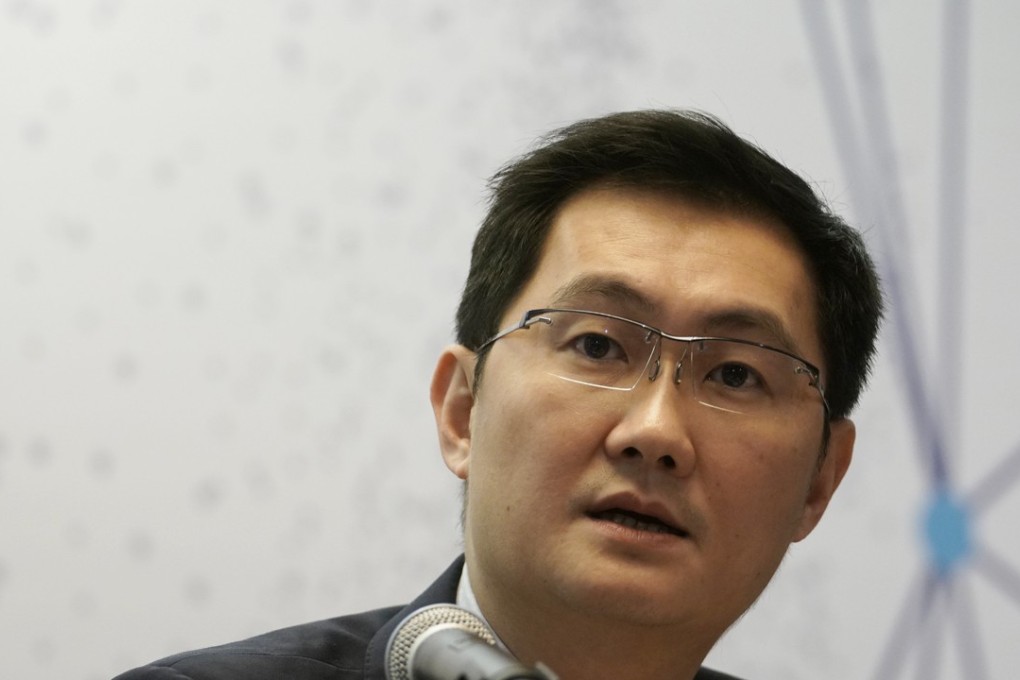

Pony Ma loses US$710 million as Facebook rout weighs on shares of Chinese social media giant Tencent

Tencent shares have plunged by 22 per cent since January, wiping off about HK$1 trillion in market value

Pony Ma Huateng, the founder of Tencent Holdings and China’s second-richest man, has lost HK$5.6 billion (US$710 million) in the last two days, after Tencent stock took a beating along with other social media operators.

Shares in the social media and gaming giant dropped by a combined 1.8 per cent on Thursday and Friday, trading at HK$373.00 by Friday’s close. Pony Ma, who owns about 820 million shares of Tencent, lost about HK$5.6 billion in the process. His current net worth stands at US$37.9 billion, next to Alibaba Group Holding chairman Jack Ma Yun’s US$44.6 billion on the Chinese billionaires list, according to data compiled by Bloomberg.

The company has already suffered a steep fall in share prices this year. Compared with its peak of HK$476.60 a share in January, it has lost 22 per cent, erasing HK$985 billion off its market value.

On Thursday, US social media behemoth Facebook dropped by about 19 per cent, wiping out US$120 billion in market cap in a single day – the biggest one-day loss in a company’s value in US market history. The plunge was triggered by weaker than expected key metrics at Facebook. More importantly, the company’s management warned that growth in future revenue could slow significantly in the wake of the European Union’s new data privacy laws and the Cambridge Analytica scandal.

The plunge hurt other social media rivals too, with Twitter tumbling by 2.9 per cent on Thursday. The huge loss at Facebook has triggered concerns that growth and valuations at social media companies might have peaked.

Social media has peaked. We told you last quarter and now we’re seeing

Ross Gerber, chief executive at Gerber Kawasaki Wealth and Investment Management, said Facebook’s figures suggested it may be a turning point for it and other social media companies. “Social media has peaked. We told you last quarter and now we’re seeing it,” he said on Twitter.