Supplying lithium gets trickier as electric revolution quickens

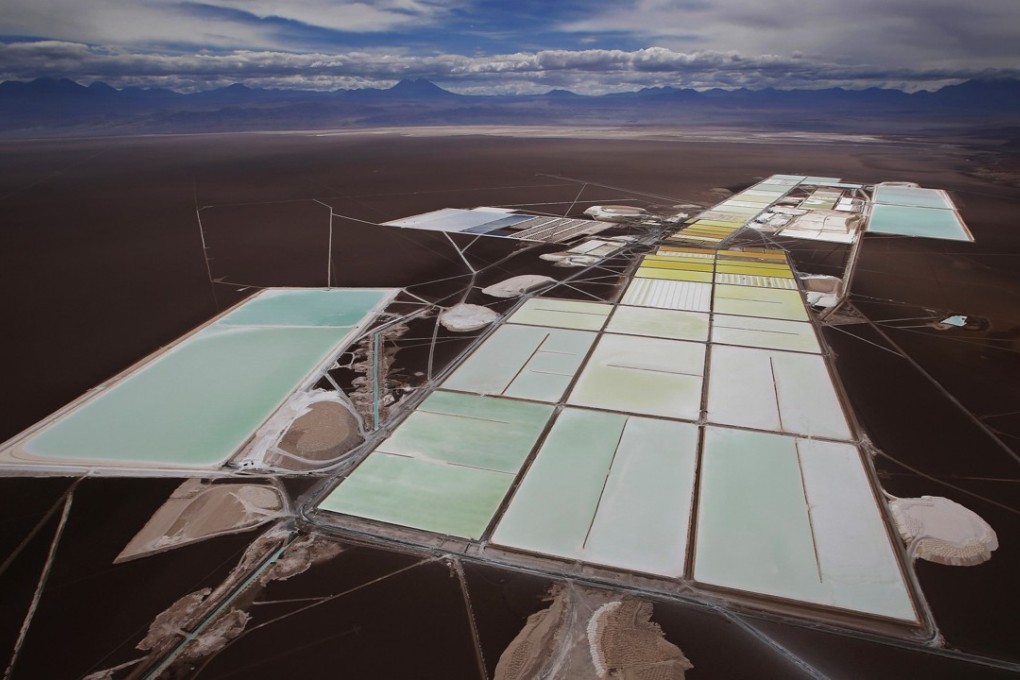

Hidden within the salt flats high in the Andes mountains of South America are vast deposits of the lithium that Elon Musk may need for his electric-car revolution. But extracting the mineral from brine ponds created by Orocobre Ltd. has proved more difficult than expected.

Bad weather and pump glitches meant production at the Olaroz facility in northern Argentina was 21 per cent below Orocobre’s initial target in the year through June. While things are getting back on track, chief executive officer Richard Seville says the company “either underestimated the complexity or overestimated our capability.”

“The uncertainty on the supply side is driving prices up and making investors nervous,” said Daniela Desormeaux, CEO of Santiago-based lithium consulting firm SignumBOX. “We need a new project entering the market every year to satisfy growing demand. If that doesn’t happen, the market will be tight.”

Australia is the biggest lithium producer, though Chile and Argentina account for 67 per cent of global reserves, according to the U.S. Geological Survey.

Extracting lithium from the salt flats that dot the arid northern regions of the South American countries is a lot easier and cheaper than digging underground for metals like copper. Producers just pump the brine solution into evaporation ponds, harvesting the mineral once the moisture is gone.