Blackstone cashes up for more big mainland deals

Conditions are right, says chairman of firm on lookout for 'below the trend' property targets

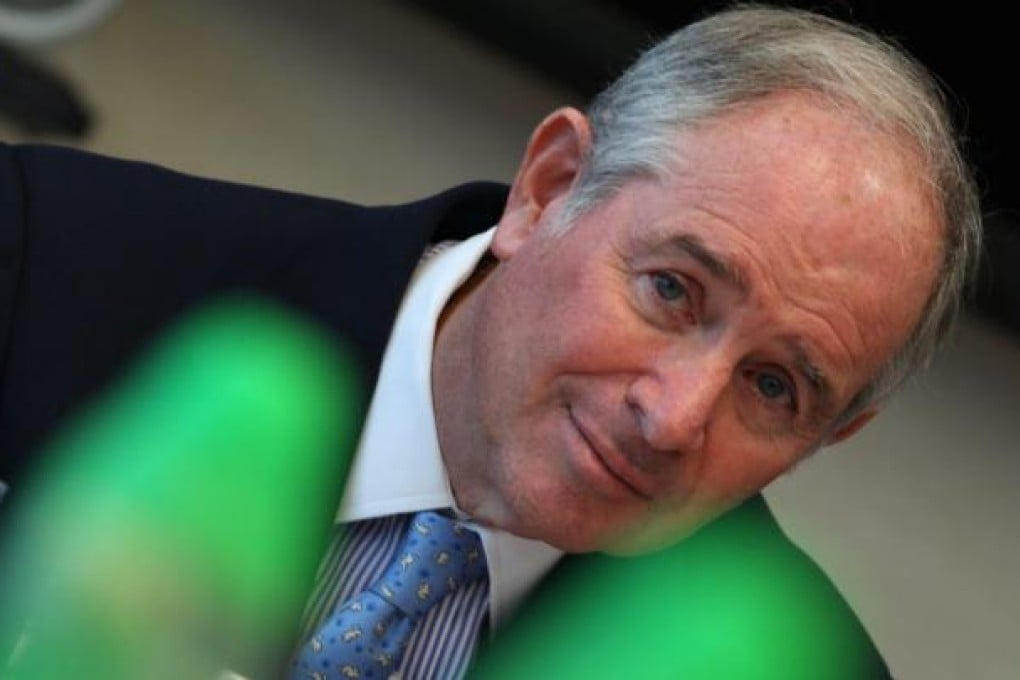

Blackstone Group, the world's largest alternative asset manager, is on track to make big-ticket deals in Asia's property market.

The worries come after years of efforts by Beijing to check rising property prices and speculation.

Blackstone, already one of the largest property investors globally, raised a record US$13.3 billion this month for its seventh real estate fund for Asia and aimed to buy assets at "discount for size", said Schwarzman.

The fund's mandate was to make deals when acquisition targets were "below the trend", he said.

Conditions in Asian markets supported making large purchases, said Schwarzman, citing India, which generated double-digit returns on an unleveraged basis for the firm last year, while Australia also posted meaningful yields.

"We look for deals that allow us to add value by making improvements, and changes to an existing project," he said. Blackstone would not buy a building just because "it looks nice".