China goes all out to secure lithium, cobalt supplies – key to dominating the world electric car market

Cobalt, however, faces bigger challenges than lithium, which has seen bigger price gains over the past two years amid lack of certainty over new supplies, stockpiling and traders taking speculative positions

The emergence of electric vehicles has seen Chinese companies go on a global hunt to secure lithium resources. Now they are rapidly clinching deals to get hold of cobalt whose supply is even more concentrated geographically.

Cobalt, a hard, shiny, greyish metal, a by-product of copper and nickel mining, has seen the biggest price increase among various metals used to make electric vehicle batteries after a demand boom began two years ago, according to Ciaran Roe, global manager of metals pricing at S&P Global Platts.

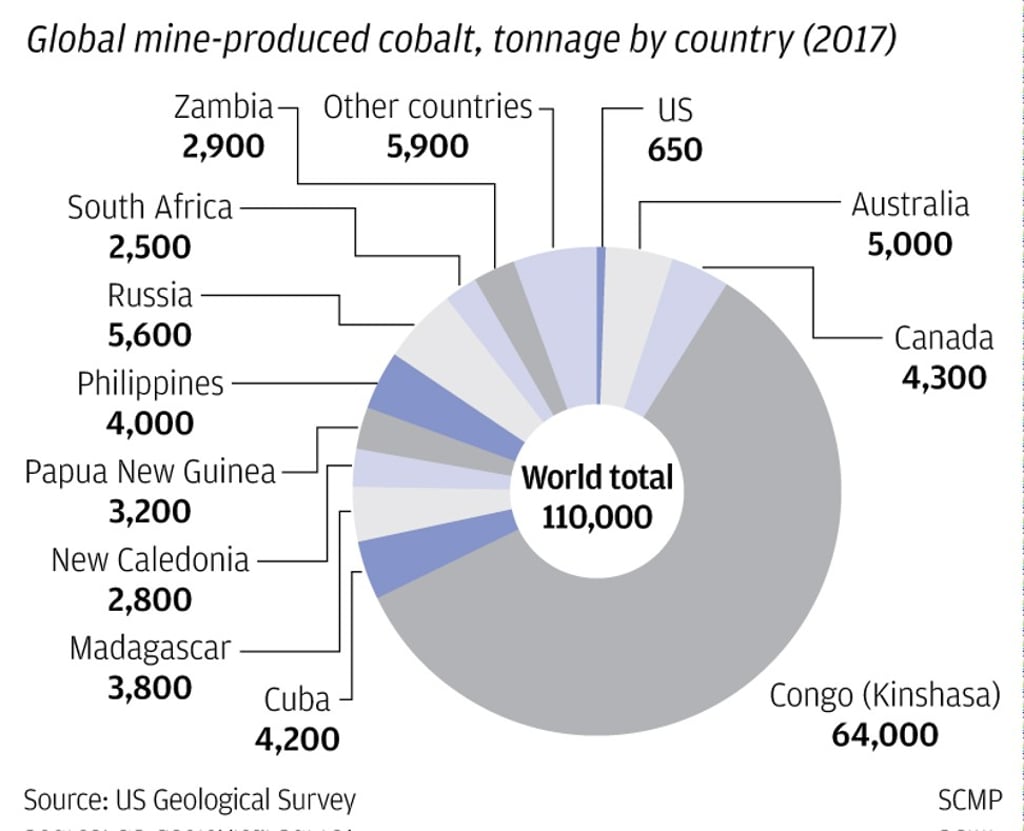

“Unlike manganese, lithium and nickel, cobalt is limited in supply not just in terms of tonnage but also origin,” he said. “I can’t think of another commodity where supply is so reliant on one origin nation than cobalt.”

Almost 60 per cent of the world’s unrefined cobalt output last year came from the Democratic Republic of Congo in central Africa, whose output was more than 10 times that of the second producer Russia, according to US Geological Survey. Congo also has just over half the world’s reserves of the metal.

Although demand for lithium and cobalt is expected to rise two to three-fold in the eight years to 2025, the sources of new supply of cobalt is far less clear than that of lithium, Roe noted.