Hong Kong shares fall after Fed signals slower easing next year

Federal Reserve’s hawkish forecast for just two rate cuts next year dampens sentiment

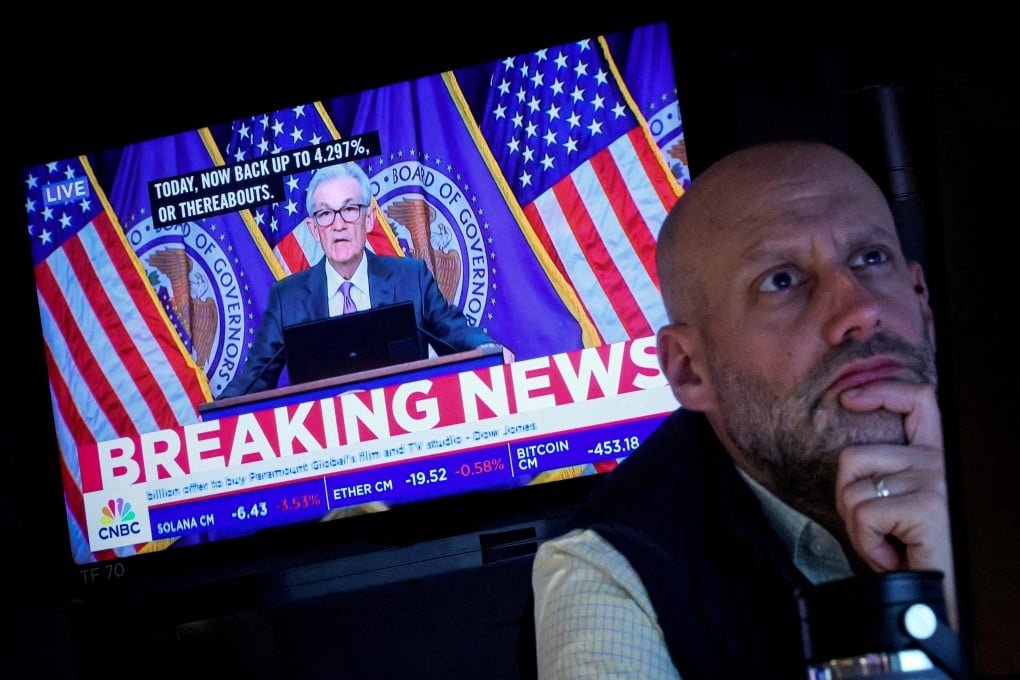

Hong Kong stocks fell following the US Federal Reserve’s unexpected hawkish forecast for interest rate cuts next year.

The Hang Seng Index declined 0.6 per cent to 19,752.51 at the close on Thursday, after slumping as much as 1.4 per cent intraday. The Hang Seng Tech Index retreated 0.7 per cent. On the mainland, the CSI 300 Index added 0.1 per cent and the Shanghai Composite Index declined 0.4 per cent.

Fed chairman Jerome Powell said the slower pace of rate cuts reflects both the current inflation and expectations of higher inflation next year. The adjusted forward-guidance language in the Fed’s policy statement said that it was “considering the extent and timing of additional adjustments”, which indicated a possible pause on rate cuts at the next meeting in January.

The Fed has entered “the pause phase” of its monetary policy, said Jack McIntyre, portfolio manager at US investment firm Brandywine Global. “The longer it persists, the more likely the markets will have to equally price a rate hike versus a rate cut. Policy uncertainty will make for more volatile financial markets in 2025.”