Kaisa says it has creditors’ support as it unveils debt workout plan to avoid liquidation

- Kaisa offered creditors several payment options, including new notes denominated in US dollars and mandatory convertible bonds that can be exchanged into shares

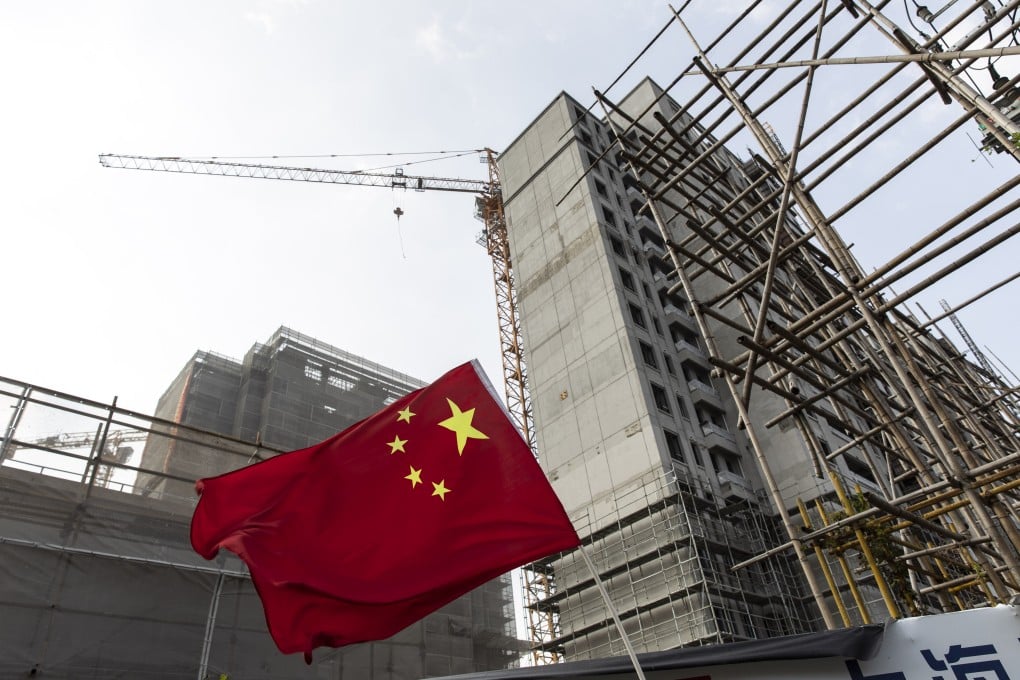

Kaisa Group has unveiled its long-awaited debt workout plan to avoid a showdown during next month’s liquidation court hearing in Hong Kong, the first time the Shenzhen-based developer is restructuring its finances since defaulting on US$12 billion of offshore bonds in 2021.

The developer offered its creditors several payment options, including new notes denominated in US dollars, and mandatory convertible bonds (MCB) that can be exchanged into new Kaisa shares, according to a filing to the Hong Kong stock exchange on Tuesday.

Six tranches of senior notes totalling more than US$5 billion and eight tranches of MCBs with an aggregate principal amount of US$4.8 billion will be allocated to creditors, based on their respective ratios in the workout scheme, according to the plan.

In addition, the developer may issue new shares one or more times to existing shareholders, to which its founder Kwok Ying-shing and his brother Kwok Ying-chi will contribute 115 million yuan (US$16.1 million) in the form of a shareholder loan, Kaisa said.

The restructuring plan had been agreed by a group of bond holders with more than 34 per cent of Kaisa’s debt and over 36 per cent of the debt in Kaisa’s Rui Jing unit, the company said.

“The contemplated restructuring is intended to provide the company with a long-term runway to stabilise the business, and allow adequate financial flexibility to achieve a sustainable capital structure and enhance its net asset value, and protect the rights and interests, and maximise value, for all stakeholders,” Kaisa said.