China’s first-quarter IPOs plunge 65% as regulator’s focus on listing quality saps pipeline

- IPOs have raised 23 billion yuan (US$3.18 billion) in the first quarter, compared with 65.1 billion yuan in the same period in 2023

- ‘The slowdown in IPOs will carry on, and the listing process for mega IPOs is expected to be lengthened,’ analyst says

Twenty-eight companies have raised a total of 23 billion yuan (US$3.18 billion) by selling new shares on the mainland’s three exchanges, compared with 68 listings that raised 65.1 billion yuan in the first three months of 2023, according to Bloomberg data.

These steps add to measures that have been in place since August to slow the pace of new offerings to bolster investors’ confidence.

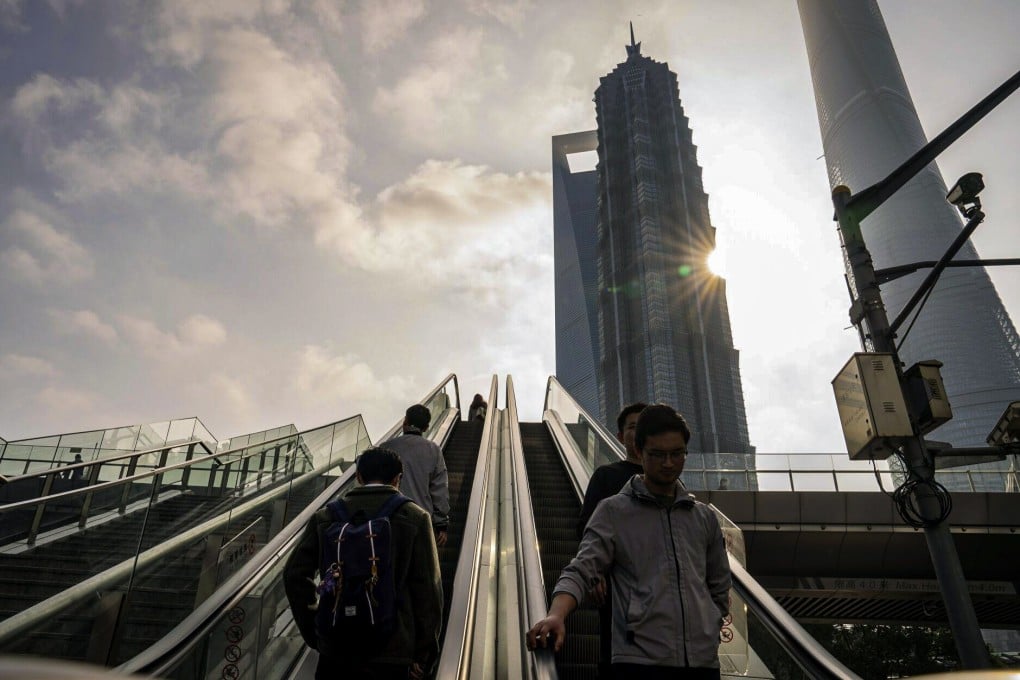

“The slowdown in IPOs will carry on, and the listing process for mega IPOs is expected to be lengthened,” said Wang Zhengzhi, an analyst at Guotai Junan Securities in Shanghai. “The purpose is to guard against risks and promote the high-quality development of the capital market.”

The biggest IPO this year is Grandtop Yongxing Group, a Guangdong province-based waste treatment company that started trading in Shanghai on January 18 after raising 2.43 billion yuan, Bloomberg data shows. That is about half the size of the most valuable deal in the January-March period in 2023, when Hunan Yuneng New Energy Battery Material raked in 4.5 billion yuan on the Shenzhen bourse. Grandtop now trades at about 18 per cent below its offer price of 16.20 yuan.