Evergrande Property Services loses half of its value as stock resumes trading after 16-month halt

- The stock lost HK$11.6 billion (US$1.5 billion) in market value as investors dumped about 470 million shares, or 12 per cent of its free-floating shares

- The resumption in trading of Evergrande Property Services comes after sister firm China Evergrande NEV ended a 16-month suspension last week

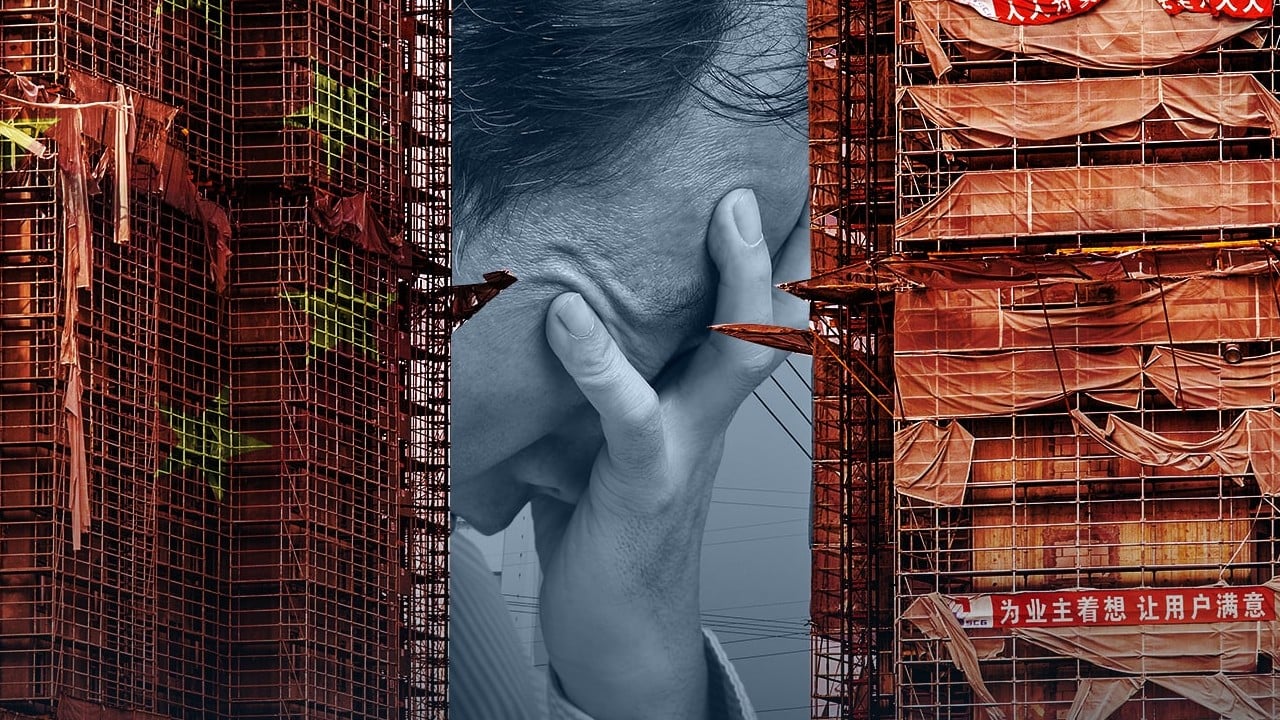

Evergrande Property Services Group, the property-management affiliate of troubled developer China Evergrande Group, plunged in Hong Kong after the stock resumed trading following a 16-month suspension.

The stock fell by 47 per cent to HK$1.21 on Thursday, wiping out HK$11.6 billion (US$1.5 billion) in market value, with about 470 million shares, or 12 per cent of its free-floating shares, changing hands. It had lost as much as 51 per cent in intraday trading.

China Evergrande, once the nation’s top-ranked developer, has been mired in a liquidity crunch over the past couple of years, becoming one of the most affected developers of Beijing’s rigid three red lines policy initiated in mid-2020 to curb leverage in the industry.

The developer’s business woes have spilled over to Evergrande Property Services and China Evergrande NEV. The property-management unit was found to have misused proceeds from its initial public offering (IPO) to obtain loans for China Evergrande Group, while the future of the NEV arm is uncertain because of a lack of funding support from the parent.