Evergrande to buy property projects off its EV unit to sweeten US$19 billion debt restructuring plan

- The group’s carmaking arm, China Evergrande New Energy Vehicle (NEV) Group, will sell 47 of its health and living projects to Evergrande to take “the NEV segment to its next stage of growth”

- The electric vehicle unit is a key part of Evergrande’s massive restructuring plan, as the developer offers offshore creditors an option to swap debts for shares of some of its affiliates, such as Evergrande NEV

Embattled China Evergrande Group will take over residential and property projects of its new energy vehicle (NEV) unit for an initial consideration of just 2 yuan (US$0.29) as it seeks to make the carmaker attractive to offshore creditors days before a deadline to accept a restructuring of its US$19 billion offshore debt.

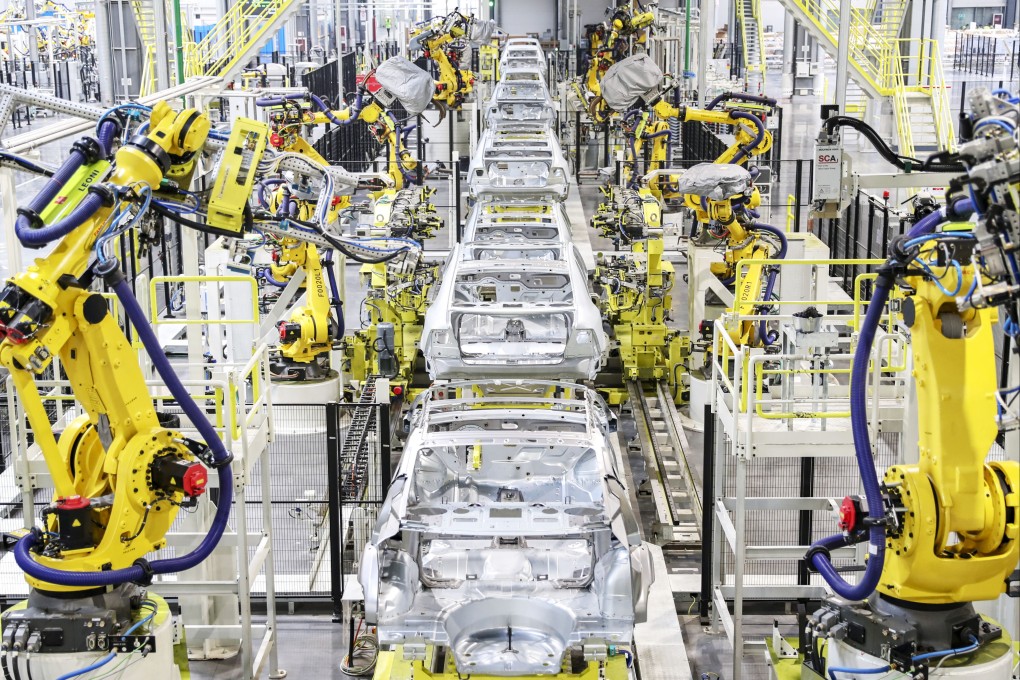

The group’s carmaking arm, China Evergrande New Energy Vehicle Group (Evergrande NEV), will sell 47 of its health and living projects to Evergrande to “focus on the NEV segment and deploy appropriate resources towards the research, development and production of NEVs”, it said in a filing on Monday evening.

The group has defaulted on some US$20 billion of offshore debt and is soliciting bondholder support for a debt restructuring proposal by April 27. The NEV unit is a key part of Evergrande’s massive restructuring plan, as the developer offers offshore creditors an option to swap debts for shares of some of its affiliates, such as Evergrande NEV.

But analysts doubt the transfer would sweeten the restructuring plan that requires consent from creditors holding at least 75 per cent of the debt value.

“Evergrande’s NEV announcement is a clear attempt to influence the Hengda bondholder vote, as the company’s offshore restructuring plans are largely dependent upon creditor acceptance of NEV shares,” said Brock Silvers, chief investment officer at Kaiyuan Capital who felt the reduction in NEV liabilities would be welcome but would do little to ameliorate investor concerns over NEV’s underlying value.

“A stronger EV focus won’t suddenly create enthusiasm for a new and unproven entrant under questionable management in a rapidly evolving tech sector that is both fiercely competitive and heavily capitalised. I still believe that offshore creditors should oppose the deal, and onshore creditors are in a stronger position and should be even less likely to agree. I don’t believe the NEV announcement will significantly alter this outlook.”