Advertisement

Chinese EV start-up WM Motor moves towards back-door listing in Hong Kong as Apollo Future Mobility plans reverse merger

- A unit of Hong Kong-listed Apollo plans to acquire the embattled electric-car maker for US$2.02 billion, according to a stock-exchange filing

- Apollo plans to raise HK$3.92 billion (US$501.8 million) by floating 7.1 billion additional shares as part of the reverse-merger deal

Reading Time:2 minutes

Why you can trust SCMP

0

Daniel Renin Shanghai

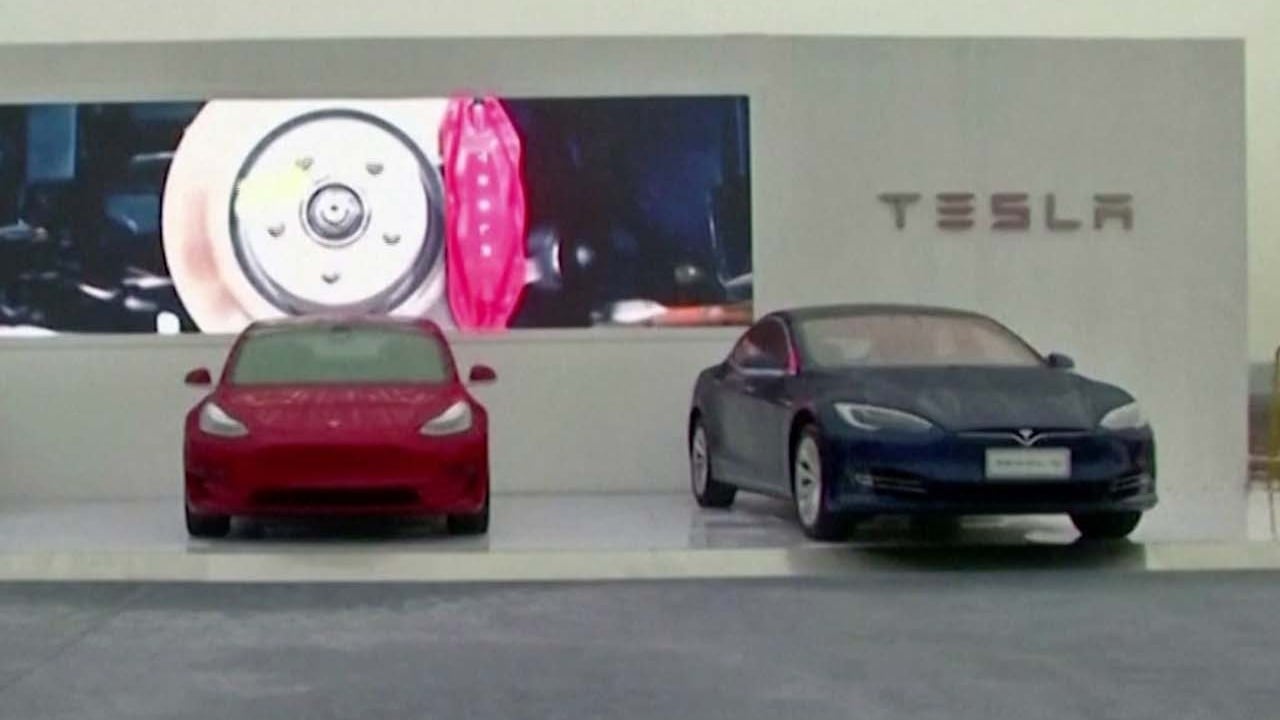

Chinese electric-vehicle (EV) start-up WM Motor edged closer to a back-door listing in Hong Kong after Apollo Future Mobility announced a plan to merge with the embattled company, which was once viewed as a potential rival to Tesla in the world’s largest EV market.

Hong Kong-listed Apollo said in an exchange filing on Thursday that one of its units plans to acquire the Shanghai-based EV maker for US$2.02 billion in a reverse-merger deal.

As part of the move, Apollo plans to raise HK$3.92 billion (US$501.8 million) by floating 7.1 billion additional shares at 55 HK cents apiece to boost cash flow and supplement working capital.

The deal is subject to a “wide range of factors” including regulatory approvals, the filing said. Apollo is involved in EV engineering and tech services but does not make cars.

Going public through a reverse-merger transaction, also known as back-door listing, would effectively bail out financially troubled WM, which has been pursuing a listing since it submitted an initial public offering (IPO) application to the Hong Kong stock exchange on June 1 last year.

Advertisement