Alibaba leads Hong Kong stocks to best gain in a week on China data while markets brace for Fed rate hike

- Reports on industrial production and retail sales exceeded market estimates, shoring up confidence in local stocks

- The Fed is seen raising its target rate by 75 basis points later today, based on market pricing, in what would be the most aggressive tightening since 1994

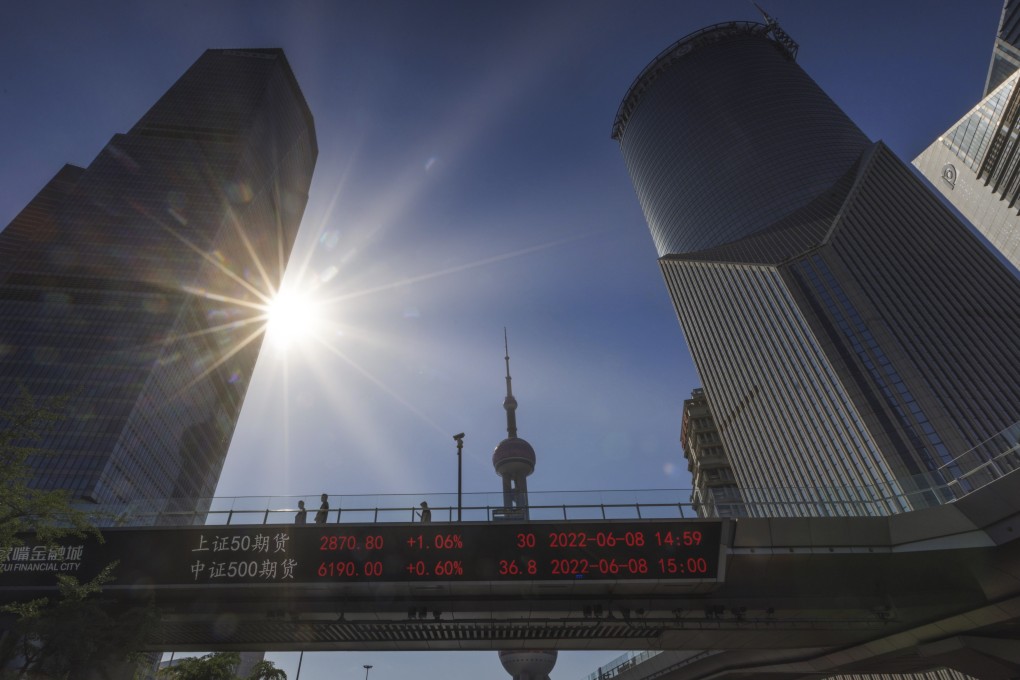

The Hang Seng Index advanced 1.1 per cent to 21,308.21 at the close of Wednesday trading. The Hang Seng Tech Index surged 2.4 per cent while the Shanghai Composite Index added 0.5 per cent.

Alibaba Group Holding led gainers, rising by 4.4 per cent to HK$105.60. Ping An Insurance rallied 8 per cent to HK$50.55 while developer Country Garden climbed 4.8 per cent to HK$4.39.

Industrial production increased 0.7 per cent in May from a year earlier, the statistics bureau said on Wednesday, beating forecasts for a 0.9 per cent contraction among economists tracked by Bloomberg. Retail sales shrank 6.7 per cent, narrower than forecasts for a 7.1 per cent drop. Fixed-asset investment gained 6.2 per cent in the first five months, in line with expectations.