‘Two sessions’ 2021: China to expand land supply to rein in runaway home prices as premier vows to get a grip on affordability

- The government will make more land available for developers to turn into housing stock to bring prices down

- The government will also increase the supply of subsidised rental homes and shared ownership housing

China’s government will make more land available for developers to increase the housing stock in the world’s largest property market, as it keeps a tight lid on runaway prices to ensure that affordability is within the reach of the nation’s first-home buyers.

The government will also increase the supply of subsidised rental homes and shared ownership housing to ensure well-regulated development of the long-term rental housing market, and cut taxes and rental fees.

“We will keep the prices of land and housing, as well as market expectations stable,” Premier Li Keqiang said in his annual work report to China’s legislature in Beijing. “We will address prominent housing issues in large cities [and] make every effort to address the housing difficulties faced by our people, especially new urban residents and young people.”

Runaway prices and affordability are listed as “difficulties” in the prime minister’s report, the most drastic prognosis on the real estate sector in recent years. Last year’s report pledged to “promote steady and healthy development of the real estate market,” while the 2019 plan was to “better address housing needs.”

Four decades of rapid economic growth has turned the communal housing of Mao Zedong’s era into some of the world’s tallest flats, biggest private housing estates and most opulent villas, in the process turning China’s property market into the largest on earth, with last year’s sales value of new homes topping US$2.7 trillion.

Under pressure to maintain short-term growth to escape the clutches of the 2008 Global Financial Crisis, “the government had to tolerate some economic problems that are detrimental to long-term stability, such as the overexpansion of the real estate industry,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “The government has zero pressure to maintain that growth, which frees its hands to deal with some of these problems.”

A housing bubble has already formed in the housing market, threatening the banking industry with financial risks, with the potential to undermine economic stability, the banking regulator Guo Shuqing said this week. About 30 per cent of China’s bank loans are now going into the real estate industry, either as personal mortgages for homebuyers, or as financing for developers, he said.

“Many people buy homes not to live in, but to invest or speculate,” he said, likening the property market leverage to a “grey rhino” risk to the broader economy. “This is very dangerous.”

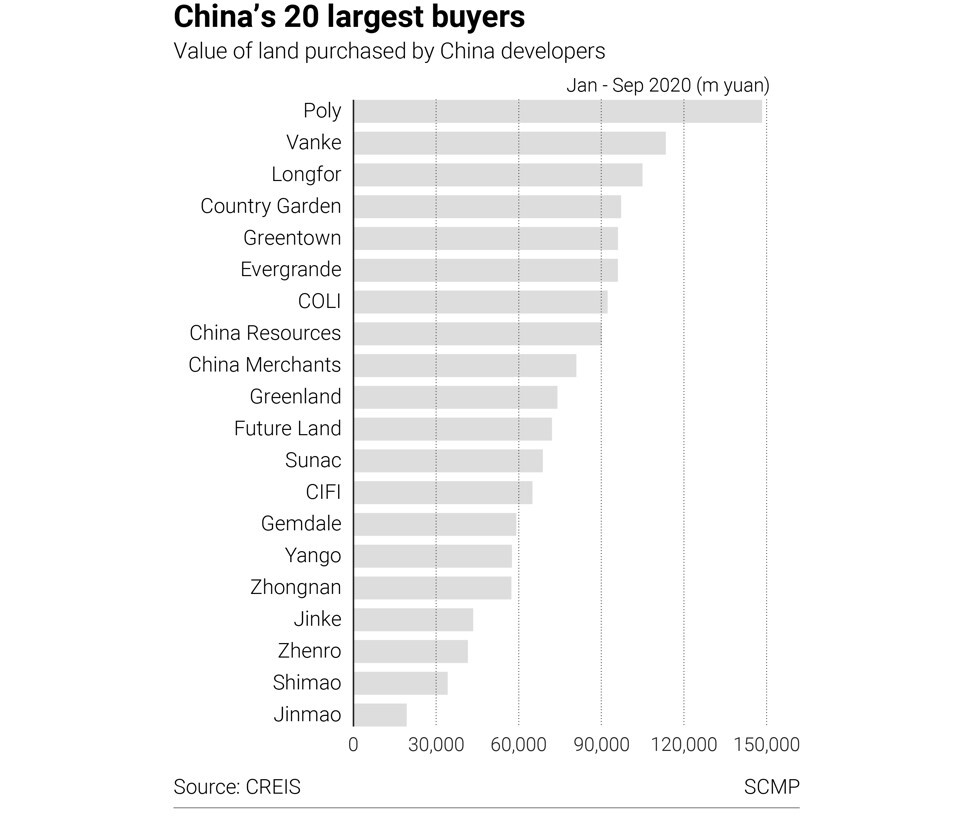

The government, which leases land usage rights to developers to turn into homes, offices, or shops, will increase the supply of land. Special funds will also be earmarked, and concentrated development schemes will be carried out, according to Li’s report.

The central government is standardising the auction of land usage rights by local authorities to three a year, eschewing the current random process where municipal or provincial governments can call for tenders – and compete with each other – whenever they need to plug a revenue deficit. As many as 22 city governments including Beijing, Shanghai and Shenzhen will abide by this schedule, according to a notice by the Ministry of Natural Resources last week.