Real estate moguls with a Greece-size debt problem look for hints of relief, even as China’s legislature tries to wean industry off its loans

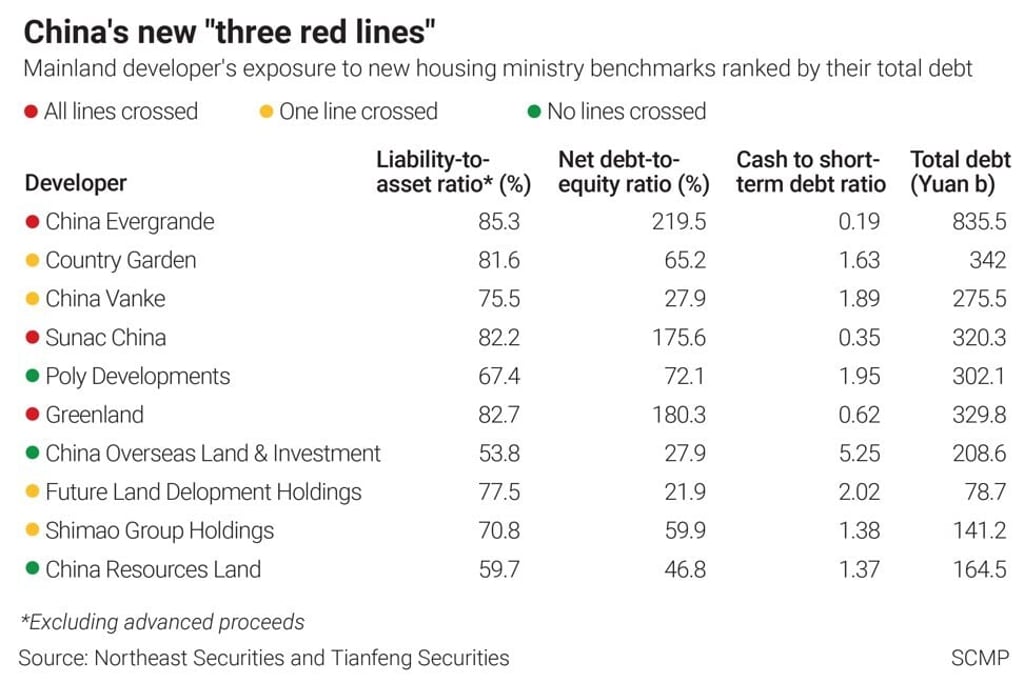

- Fifteen of the delegates at the ‘two session’s are developers, owning property companies with 2.44 trillion yuan (US$377 billion) of debt between them

- All but one of the 15 developers represented are in breach of one, if not all, of the Chinese central bank’s so-called Three Red Lines capital requirements

China’s political elite will face a number of political challenges when they gather in Beijing next month for the year’s biggest legislative set piece – the meetings of the National People’s Congress and the Chinese People’s Political Consultative Conference, informally known as the “two sessions”. In this latest part of a series looking at the key items on the agenda, we examine the country’s military spending. You can read part one here.

China’s property developers, who replaced managers of decrepit state-owned factories as the nation’s largest debtors, will be in the hot seat when they show up next week at the Great Hall of the People for their annual legislative meeting in Beijing.

“They have to present a doable solution at the two sessions, showing how they are going to reduce their debt and what their schedules are,” said Phillip Zhong, senior equity analyst at Morningstar.

“They need to give their word to the central government that they can get there at some point, and will not be the ones that bring systematic risk to the country’s economy, which is the biggest concern of Beijing right now.”