US-China cross-border investments hit 5-year low as decoupling deepens amid trade war

- Investment between the US and China plunged 18 per cent to US$13 billion in the first six months of 2019, report says

- The study was conducted by the Rhodium Group and the National Committee on US-China Relations

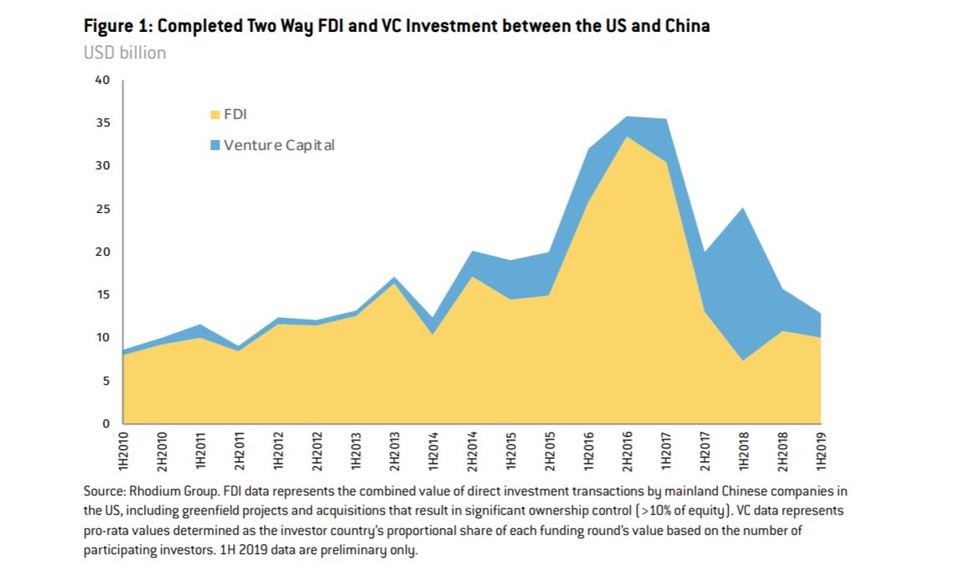

American and Chinese investors’ appetite to deploy capital into each other’s projects and deals has dropped to a five-year low as trade tensions propelled the decoupling of the two economies.

Investment between the United States and China plunged 18 per cent to US$13 billion in the first six months of 2019 and reached the lowest level since the first half of 2014, according to a report released on Thursday by the Rhodium Group and the National Committee on US-China Relations.

The drop reflects an increasingly hostile investment environment between the world’s largest economies that has been exacerbated by the trade war and an economic slowdown in China.

“The decline was primarily driven by Chinese [capital control] policies and market conditions,” the report said.

Global outbound mergers and acquisition activity by mainland Chinese firms declined sharply “as Beijing has tightened administrative control on outbound capital flows to address financial system risks and macroeconomic concerns”, according to the report.

“Efforts to rein in high debt and financial leverage, slowing domestic growth and growing geopolitical risk have further weighed on firms’ ability to invest abroad,” it said.

Investors pull cash from US-based China region funds for 8th straight week

The slowdown was also a result of stricter deal reviews of foreign acquisitions imposed by the US government.

US regulators triggered a number of asset sales, including Beijing Kunlun being forced to sell US gay dating app Grindr and iCarbonX being ordered to sell its stake in health research app Patientslikeme.

Chinese foreign direct investment in the US fell to US$3.1 billion in the first half of the year. While it was up slightly from US$2.6 billion in the first half of 2018, the level was well below previous periods.

The drop marked a trend, with US$5 billion in acquisitions and greenfield investments recorded in 2018, a 95 per cent drop from its peak in 2016. Greenfield is an investment made by a company establishing operations in a foreign country.

The largest sector decline came in property and hospitality, where direct investments fell to US$280 million from January to June, from US$8.66 billion in the first half of 2016.

How Chinese firms are preparing for a potential US break-up

The largest acquisition was Shandong Ruyi Group’s US$1.6 billion purchase of Invista’s apparel and advanced textiles business in January, which accounted for more than half of the total deal volume.

Venture capital investment into the US, a bright spot last year, also dropped in the first six months.

On the flip side, US capital into China was flat from January to June, compared with the same period last year. Direct US investment in Chinese information and communications technology dropped by nearly half, to US$1.65 billion from two years ago, while interest in electric vehicles, entertainment and biotech largely held up.