Strategists can’t agree on what’s in store for China stocks in 2019

- Bocom International’s Hong Hao says China stocks will probably trough in 2019, but cautions that returns may be limited

- UBS and Citic Securities are bullish on equities, citing battered valuations and policy easing

Top investment strategists are deeply divided on the outlook for mainland stocks next year, as Chinese policymakers step up efforts to bolster economy, reversing the austerity that helped take the air out of asset prices this year.

UBS Group and Citic Securities are bullish on Chinese stocks based on an outlook that involves policy easing and appealing valuations. However, Bocom International Holdings and Shenwan Hongyuan Group argue that equities will remain under pressure throughout 2019.

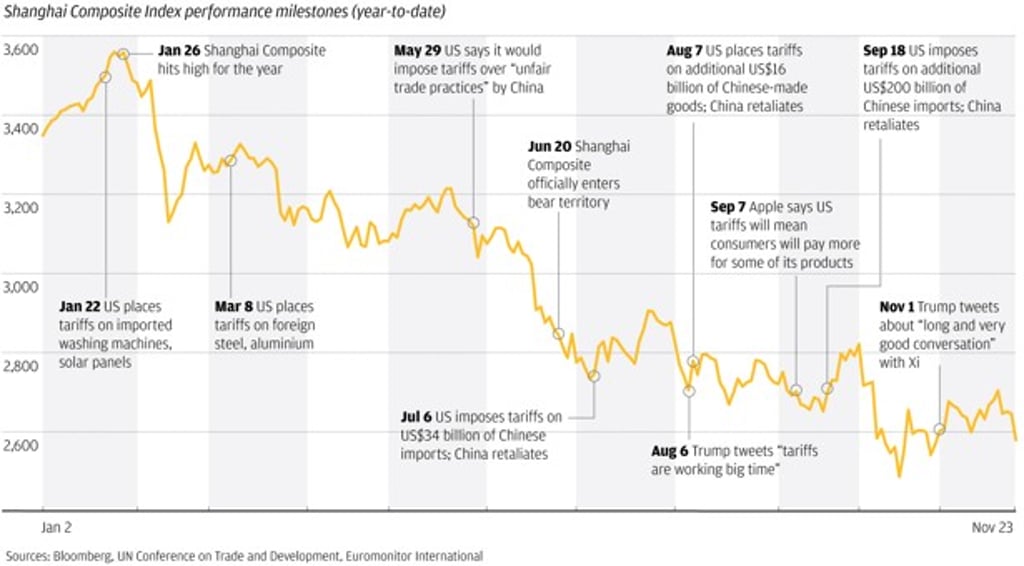

The divided outlook underscores cautiousness among top strategists after almost all were inaccurate in forecasting Chinese stocks in 2018, having underestimated the impact of the US-China trade war and a deleveraging campaign by Beijing. Most forecasters agree that stocks will hit a bottom in 2019 after President Xi Jinping pledged “unwavering” support for private companies and Vice-Premier Liu He publicly talked up equities.

Still, there is little consensus over whether Chinese stocks will resume an upwards trajectory.

“The market will trough in 2019 with the help of policies, but will be hampered by the trade dispute,” said Hong Hao, a managing director at Bocom International Holdings in Hong Kong. “Historically, an A-share trough can be protracted for well over a year. As such, we shall temper our expectations regarding market returns next year.”

Hong was the most accurate in forecasting Chinese stocks this year among major investment banks. He predicted in December last year that the benchmark Shanghai Composite Index would move between 2,800 and 3,900 in 2018. The gauge has so far traded in a range from 2,449 to 3,587, and has never reclaimed 3,300 after breaching the level in March.