China’s stock exchanges cede Asia crown to Japan as investors flee Chinese equities amid trade war

Stocks are weighed down by trade war and domestic drive to reduce debt; the benchmark Shanghai index has sank 4.6pc this week

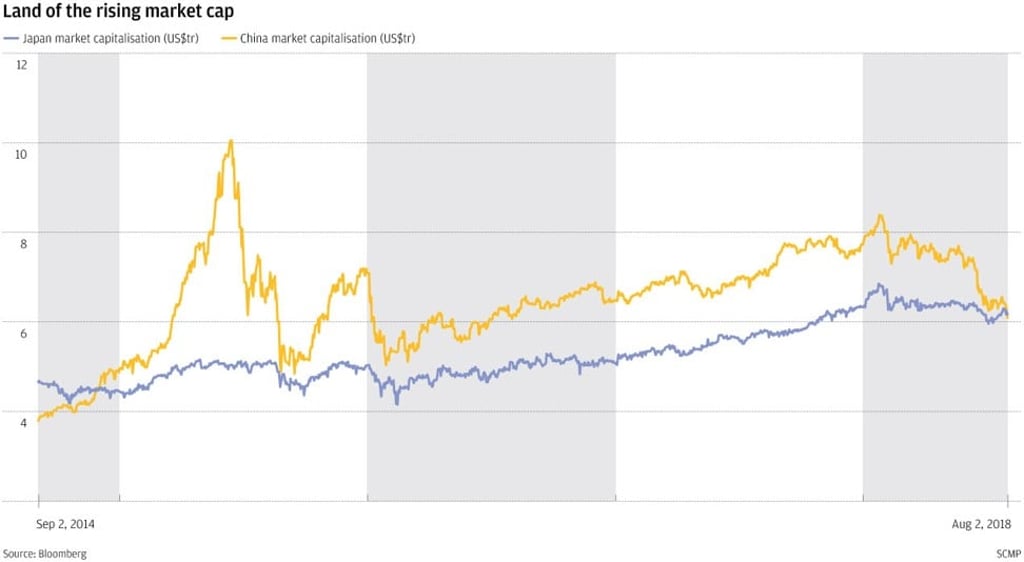

China has just ceded its four-year title as the world’s second-largest stock market to Japan, as Chinese equities continue to lose ground on Friday amid the country’s intensifying trade spat with the US and its campaign to reduce leverage weighed on equities.

The mainland Chinese markets were capitalised at US$6.09 trillion, losing out to Japan’s US$6.17 trillion, according to Bloomberg data. China’s benchmark Shanghai Composite Index has slipped into the bear market territory this year and is heading for an annual loss of 17 per cent, as traders dumped stocks after the Trump administration started to levy tariffs on Chinese imports and financial deleveraging restrained liquidity.

The Shanghai Composite Index fell 1 per cent, or 27.58 points, to close at 2,740.44 on Friday. The index has sank 4.6 per cent this week, the biggest weekly loss since February 9.

The decline of Chinese equities had resumed this week after the White House threatened to more than double the tariffs on proposed US$200 billion worth of imports from the Asian nation. The new round of sell-off came even after Chinese policymakers have begun fine-tuning policies to counter a possible slowdown, boosting expenditure on infrastructure investments, adopting a more proactive fiscal policy and softening the crackdown on shadow banking.

“China’s stock markets have made people lost so much money over the past few years, and investors have lost their faith because of the rampant frauds and scandals,” said Kingston Lin King-ham, a director at securities brokerage AMTD.

Chinese pharmaceutical stocks took a hit last week in the latest safety scandal over the nation’s vaccines, which involved several publicly listed companies.