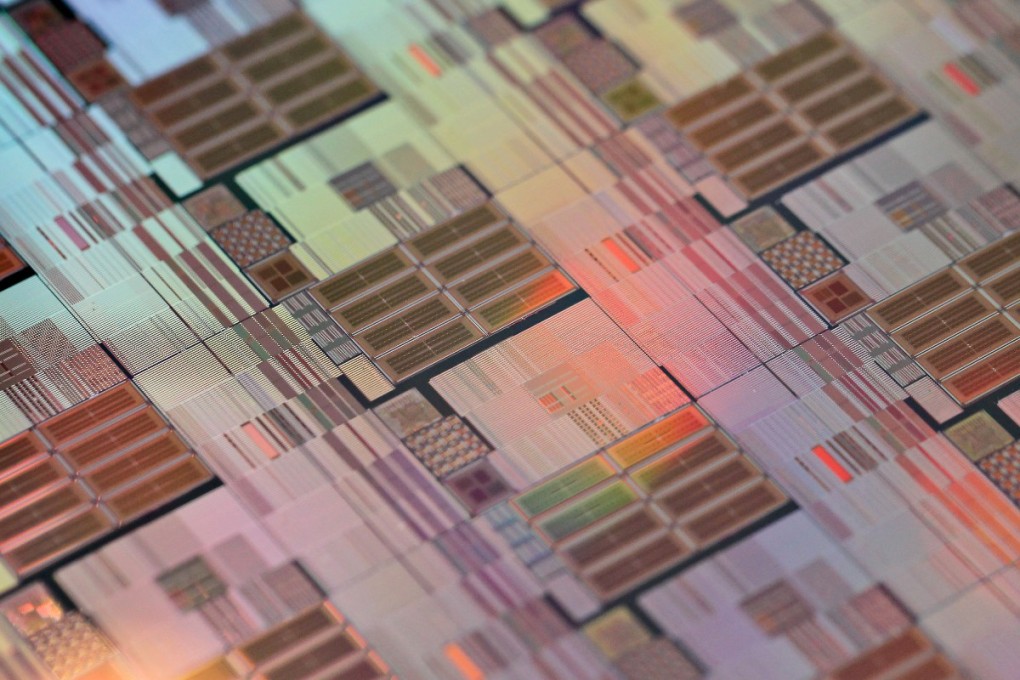

For China, semiconductors are new oil as spend on chip-related takeovers nears US$5b

China is pursuing ways to build its domestic industry and reduce reliance on imports

Beijing's hearty appetite for oil and gas acquisitions to feed its economy is starting to give way to something most people carry with them in their pockets: semiconductors.

Mainland companies spent almost US$5 billion in five major chip-related takeovers in the past 18 months, with most deals getting state funding.

That spree shows no signs of slowing as the mainland, home to 1.3 billion mobile-phone accounts, pursues ways to build its domestic chip industry and reduce reliance on imports from Taiwan, the US and South Korea. The well-funded acquisitions could mean tougher competition for smaller chip companies from those countries.

"China doesn't want to be dependent on anyone," said Michelle Chen, head of China technology investment banking at JPMorgan Chase. "There's a strong desire to build their own intellectual property, increase product depth and breadth, and, if need be, acquire intellectual property and capabilities."

The government will provide as much as 1 trillion yuan (HK$1.26 trillion) in funding over the next five to 10 years to boost the domestic market and help private companies make acquisitions at home and abroad, McKinsey & Co estimates.

Jiangsu Changjiang Electronics Technology, the country's biggest chip tester, joined the fray in November when it offered US$780 million for unprofitable Singaporean competitor Stats Chippac. Beijing-based private equity firm Hua Capital Management is tapping government funding for its US$1.7 billion bid for OmniVision Technologies, a US company whose camera sensors have been used in iPhones.