Hong Kong’s IPO environment toughest in over a decade, as rising interest rates, banking tumult, economic slowdown weigh: Deloitte

- Deloitte expects Hong Kong IPO fundraising levels to hit an 11-year low in 2023 after a 14 per cent drop in deal volumes and a 61 per cent plunge in deal value, over last year

- Some improvement can be expected in the fourth quarter after the city introduced various reforms

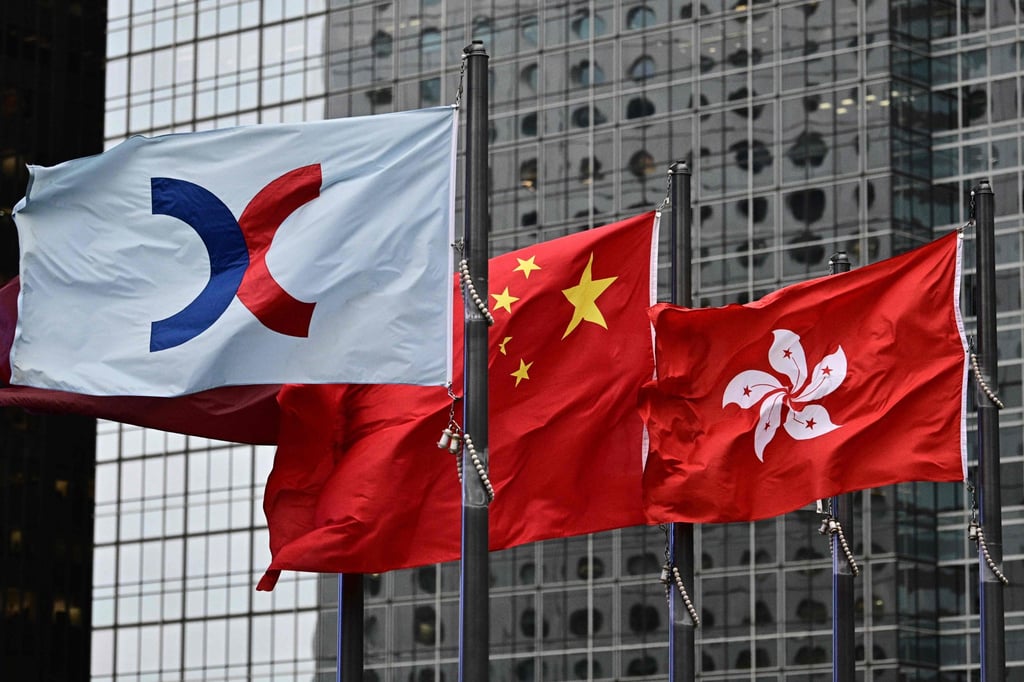

Hong Kong’s public fundraising environment is at its toughest in over a decade, as the global banking turbulence, high interest rates and slow recovery pace of mainland China’s economy bruised investor sentiment, according to Deloitte China.

Hong Kong is currently ranked eighth globally among initial public offering (IPO) fundraising centres, according to the Deloitte China Capital Market Service Group (CMSG) third-quarter report. For the full year, the consultancy expects the Hong Kong IPO market to hit its lowest fundraising level in 11 years.

“The stock market remained weak in the third quarter,” said Robert Lui, south region Hong Kong offering services leader, Deloitte China at a news conference on Friday. “Many IPO candidates continue to wait-and-see for a turnaround in market valuations while preparing and planning their offerings.”

The city is estimated to have hosted 44 IPOs, which garnered HK$24.7 billion (US$3.1 billion) in the first three quarters of 2023, compared with 51 that raised HK$64 billion in the same period last year – a 14 per cent drop in deal volumes and a 61 per cent plunge in value.

“Hong Kong remains their preferred choice given many exciting reforms that it has introduced, its unique advantages, especially as the world’s largest offshore renminbi hub, free flow of capital with access to international investors, and various connect schemes with the mainland capital market that facilitate investment links through different products,” said Edward Au, southern region managing partner, Deloitte China.