Tianqi Lithium ends trading debut on par as Hong Kong’s biggest IPO this year banks on bright industry outlook

- Tianqi Lithium’s stock price fell as much as 11.4 per cent amid concerns about valuations, social media influence before paring loss

- Tianqi Lithium collected HK$13.1 billion in net proceeds by pricing its offering at the top end of the marketed range of HK$69 to HK$82 each

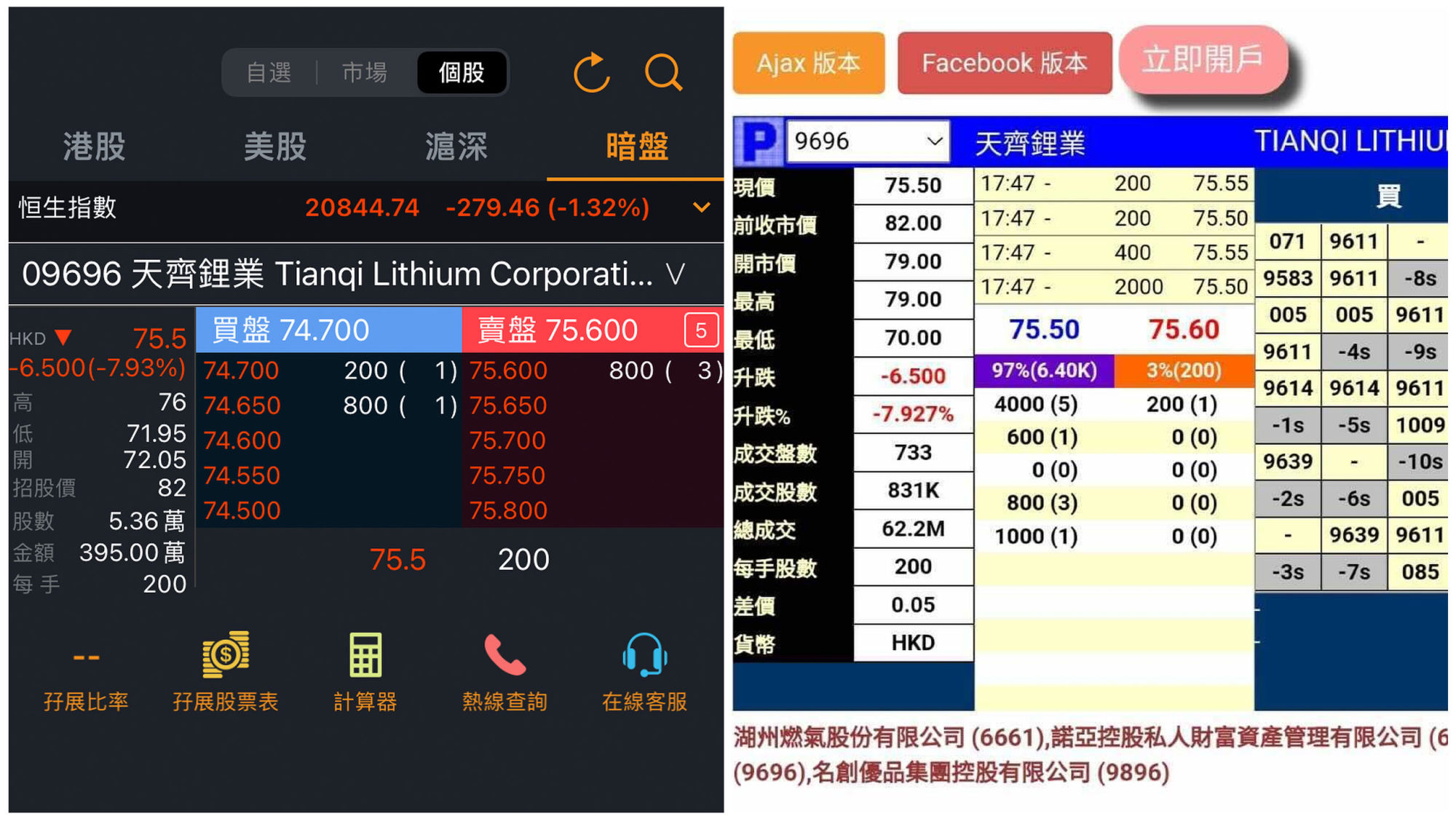

The stock closed at HK$82, unchanged from the offer price, at the close of trading. It earlier slumped to as low as HK$72.65, deeper than the HK$75.50 level indicated by grey-market prices on Tuesday. The Hang Seng Index flipped to lose 0.2 per cent.

A two-day rout in Tianqi Lithium’s shares in Shenzhen preceded its debut, spooking investors. They slumped 14 per cent over two days, having already doubled over the past three months. Postings on mainland social media by a private investor questioned its upside potential.

“Lithium prices are based on the law of supply and demand, and in the short term, supply cannot catch up with demand,” he added. “Therefore, as long as there’s a gap to fill, we are very confident about lithium prices.”

The stock climbed 0.6 per cent to 128.60 in Shenzhen on Wednesday to halt a two-day slide, giving it a hefty premium of 83 per cent over the H-shares in Hong Kong. The average premium for Chinese stocks with dual listings stood at about 45 per cent.

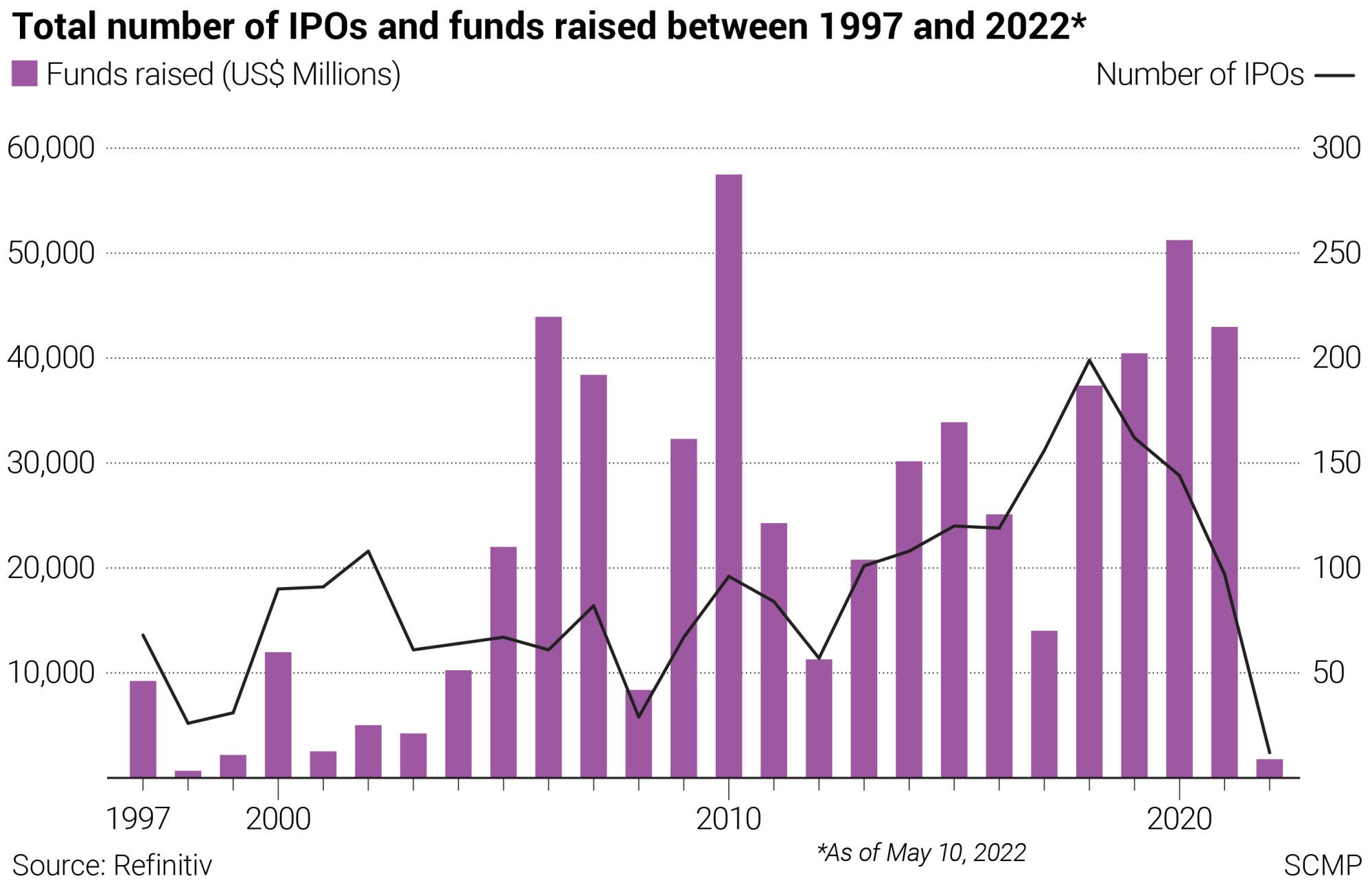

Can CALB, Tianqi Lithium recharge Hong Kong’s appetite for IPOs?

Tianqi Lithium will have a market capitalisation of almost US$30 billion. The H-shares represent about 10 per cent of its equity base while its 1.48 billion A-shares make up 90 per cent.

The stock’s earlier weakness was “due to the sell-trend partially influenced by negative comments [on the social media],” said Ivan Li, a fund manager with Shanghai-based Loyal Wealth Management. “But in the long term, [the stock price] still depends on lithium’s industrial development.”

An MSCI index tracking Chinese companies related to energy storage and autonomous vehicles has soared 52 per cent from an April low this year.

Founded in 1995 in southwestern Sichuan province, Tianqi Lithium operates three chemical plants on the mainland. The company has made big strides in the race for raw materials to feed demand for EVs, which has intensified competition for lithium mines globally.

China’s market for electric cars, which are mainly powered by lithium batteries, has seen exponential growth. EV deliveries in the country may jump to 6.6 million units by 2025 from 1.17 million in 2020, UBS said.

Additional reporting by Zhang Shidong, Daniel Ren and Cheryl Heng.