Asset managers Azimut, Hamilton Lane and Pimco eye China expansion, as Beijing accelerates QDLP and QFLP approvals

- Azimut, Italy’s largest independent asset manager, will soon launch its eighth private fund under China’s Qualified Domestic Limited Partner initiative

- ‘If you are a global asset manager, you cannot not be in China,’ says AZ Investment Management executive

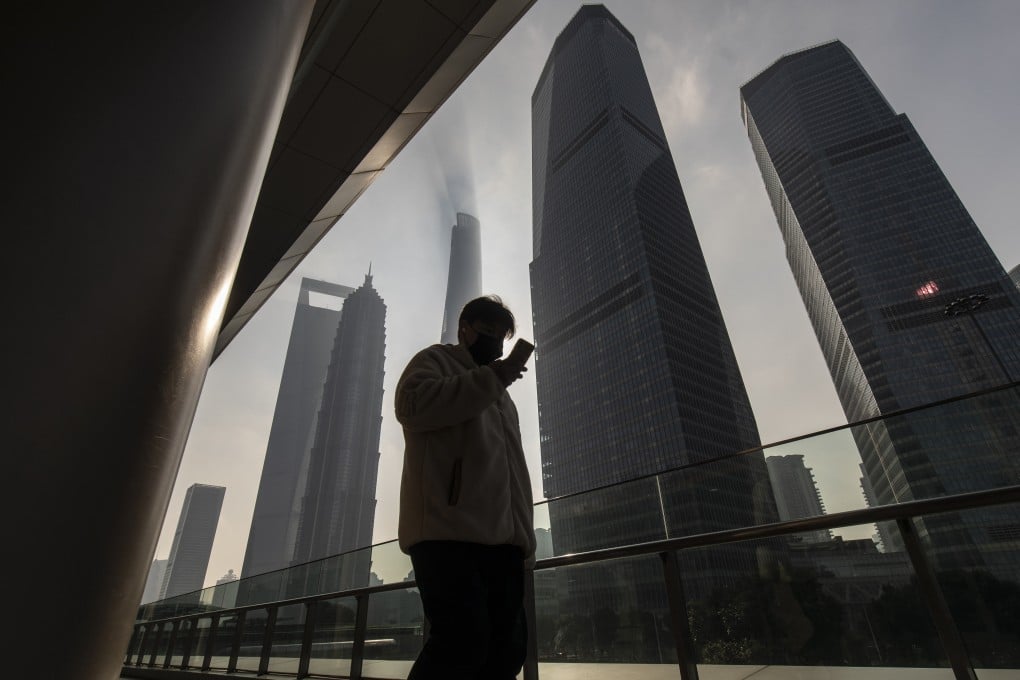

International asset managers Azimut Group, Hamilton Lane and Pimco plan to accelerate their expansion into China’s 122 trillion yuan (US$18 trillion) wealth management industry, as Beijing gives the go-ahead to more foreign players.

Azimut, which is Italy’s largest independent asset manager and is based in Milan, will in the next few months launch its eighth private fund under China’s Qualified Domestic Limited Partner (QDLP) initiative, Stefano Chao, the general manager and CIO of AZ Investment Management, an indirectly and wholly-owned unit, told the Post. The QDLP initiative allows foreign asset managers to raise funds from investors in China and invest overseas, and AZ will help investors invest in high-yield bonds in developed markets.

“If you are a global asset manager, you cannot not be in China,” Chao said. “There are many upside opportunities, as the market is very big and there are a lot of opportunities for growth.”

Beijing allows foreign asset managers to establish funds in China and engage in cross-border investment programmes including QDLP, and sister programmes the Qualified Foreign Limited Partner (QFLP) initiative, which allows licensed international funds to invest in China’s private equity and venture capital markets, and the Qualified Foreign Institutional Investor (QFII) initiative, which allows licensed foreign investors to invest in China’s stock markets in Shanghai and Shenzhen.