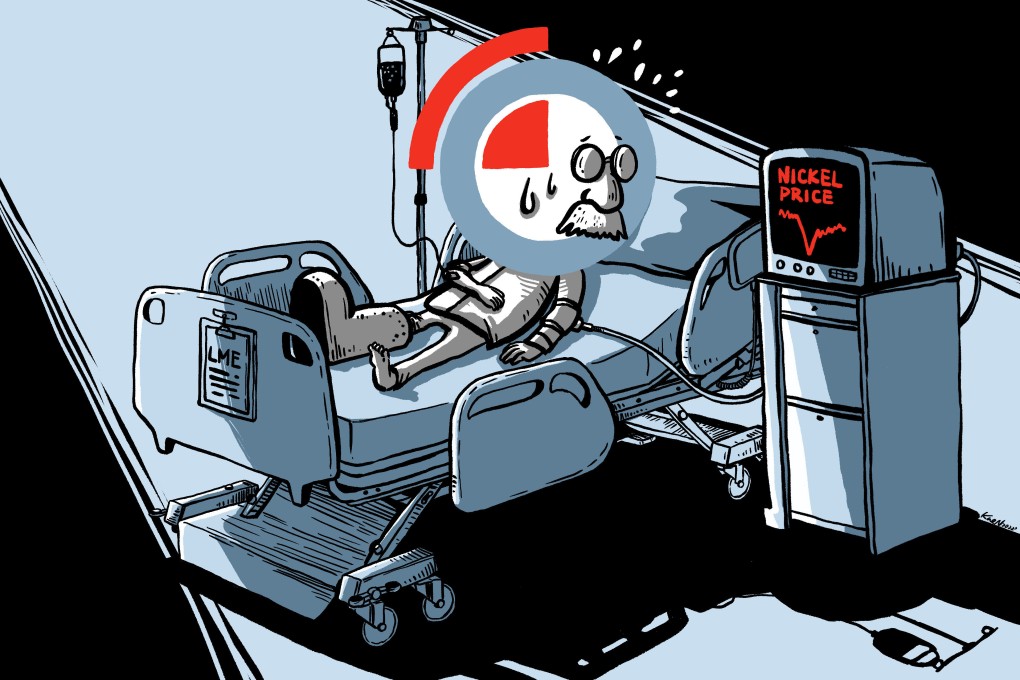

LME’s nickel rout: the world’s metals trading hub grapples for its mojo after unprecedented trading snafu

- Some traders are questioning whether the Shanghai Futures Exchange or the CME should play a bigger role in metals market

- Suspension of nickel trading, slow return of market following a short squeeze has raised concerns about LME’s approach to the nickel price crisis

Electronic trading, which resumed a week later after Tsingshan secured bank credit to honour its margin calls, stopped as soon as it started on March 16 due to a software glitch. Another glitch the next day delayed trading by 45 minutes, with various price limits put in, before contract orders started trickling in.

Nickel contracts now change hands at a fraction of their daily average volume over the past year, raising the question whether the LME – with its quaint rituals – is still reliable in setting the prices of metals such as aluminium, copper, nickel and zinc. Mainland China, the biggest worldwide consumer of industrial metals, is already offering a trading venue in Shanghai.

“They put themselves in a situation where they had a choice between several very, very bad decisions,” said Mark Thompson, a veteran trader and the executive vice-chairman of the mining development firm Tungsten West. “They took the worst of those bad decisions in cancelling trades, which effectively sounded the death knell for the LME. People have just given up on the LME, and I think this is going to continue.”