Climate change: measuring transition risks from net zero global challenge, central bankers, policymakers tell Green Swan Conference

- Global framework needed to appropriately measure climate risks, policymakers, central bankers at Green Swan Conference say

- Stranded assets from transition may range from US$1 trillion to US$4 trillion, one study found

So-called physical risks from climate change – economic costs associated with more extreme weather events – are relatively measurable, but transition risks are a more complicated calculus, according to Kristalina Georgieva, managing director of the International Monetary Fund (IMF).

“It would play over time and it would demonstrate itself as we move towards lower carbon intensity forcefully,” Georgieva said at the Green Swan 2021 conference. “We need to look into this risk already today.

“The dirty assets: how are they going to evolve. Their value will decline, would be replaced by others. How do we integrate this is a question we are wrestling with.”

03:27

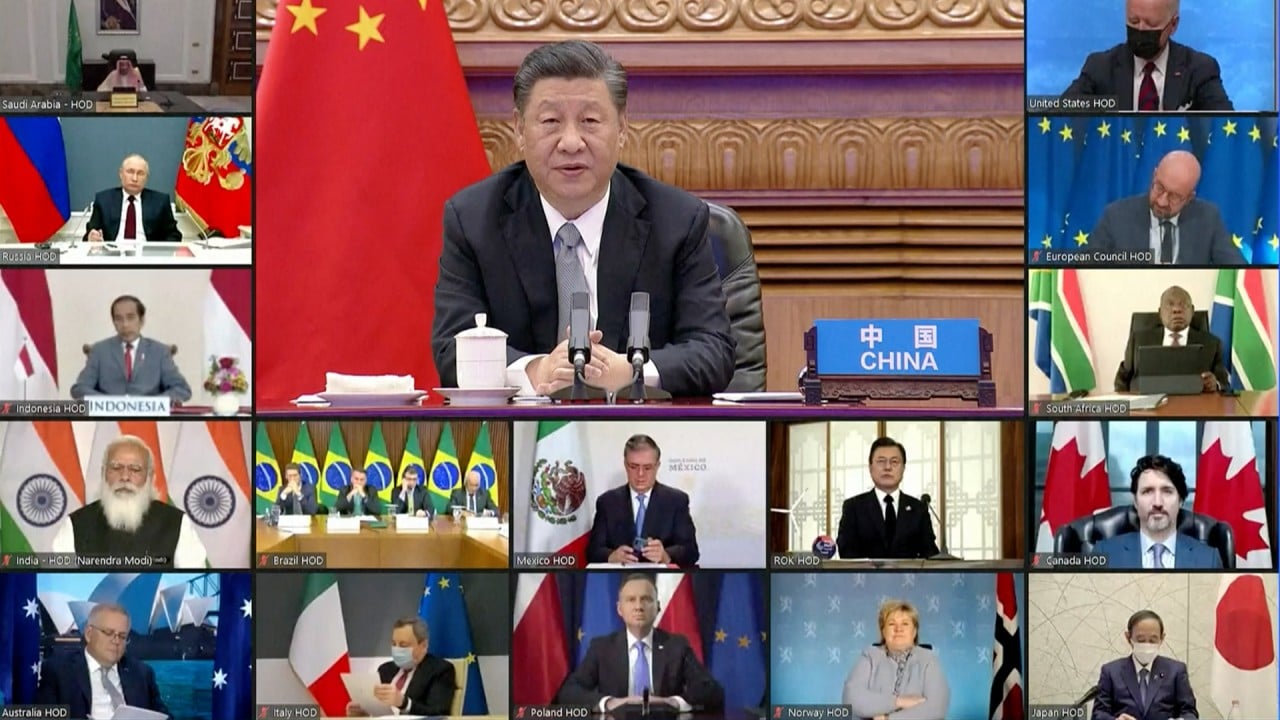

World leaders pledge to cut greenhouse emissions at virtual Earth Day summit

Policymakers, advisers and business leaders gathered virtually last week at the Green Swan conference to discuss how to address the climate crisis and incorporate climate targets into financial policy. The conference was co-sponsored by the Bank of International Settlements, the Banque de France, the IMF and the Network for Greening the Financial System.

Co-signers to the 2015 Paris Agreement have agreed to work together to cap peak emissions on greenhouse gases and to seek to limit global warming to below 2 degrees Celsius when compared with pre-industrial levels.