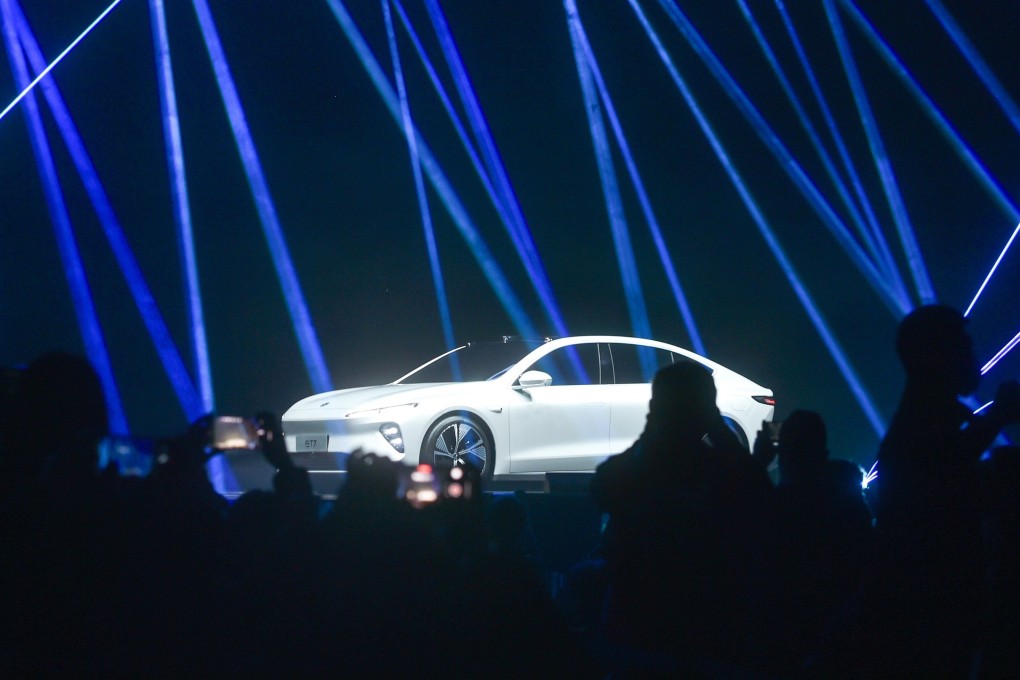

China’s EV funding war: what do US$1.3 billion of oversubscribed notes say about NIO’s prospects in world’s biggest vehicle market?

- Car maker prices US$1.3 billion worth of convertible notes more aggressively compared with a similar offering two years ago

- NIO’s 2026 and 2027 convertible notes are oversubscribed by seven times

US electric carmaker Tesla and its smaller Chinese rivals NIO and Xpeng Motors have been on a US$12 billion capital-raising drive over the past year as their share prices have soared, competing fiercely to attract investors to help fund the roll-out of new models.

The latest offering by Shanghai-based NIO shows just how much sway these fast-growing disrupters of the automobiles industry hold over investors, and how their fortunes have changed in the space of a couple of years.

01:16

Tesla exports first China-made cars to Europe with shipment of 7,000 Model 3 electric sedans

The Tesla challenger is highly likely to sell extra shares, triggering a so-called greenshoe in the jargon of capital raising, to fulfil the overwhelming number of orders from investors. The final size of the offering will rise to US$1.5 billion, the person added.