People’s Bank of China’s digital currency already used for pilot transactions worth 1.1 billion yuan

- Central bank is developing its own e-yuan as it seeks to hasten the transformation of China’s economy

- Digital currency being used for transactions ranging from bill payments to government services in pilot tests

A sovereign digital currency being developed by the People‘s Bank of China (PBOC) has been used for more than 1.1 billion yuan (US$162 million) worth of transactions as part a series of ongoing pilot programmes, according to a deputy governor at the central bank.

Speaking at the Sibos banking and financial conference on Monday, Fan Yifei said 3.13 million transactions were processed using the currency, which has been undergoing tests for much of the past year in major cities, such as Shenzhen and Xiongan. Pilots also will be conducted at the coming Winter Olympics in 2022.

The pilot programmes made “positive progress”, with more than 6,700 use cases implemented as of late August for transactions ranging from bill payments and transport to government services, Fan said.

“PBOC regards digital renminbi as an important financial infrastructure for the future,” Fan said in a recorded speech in Chinese for the conference.

03:07

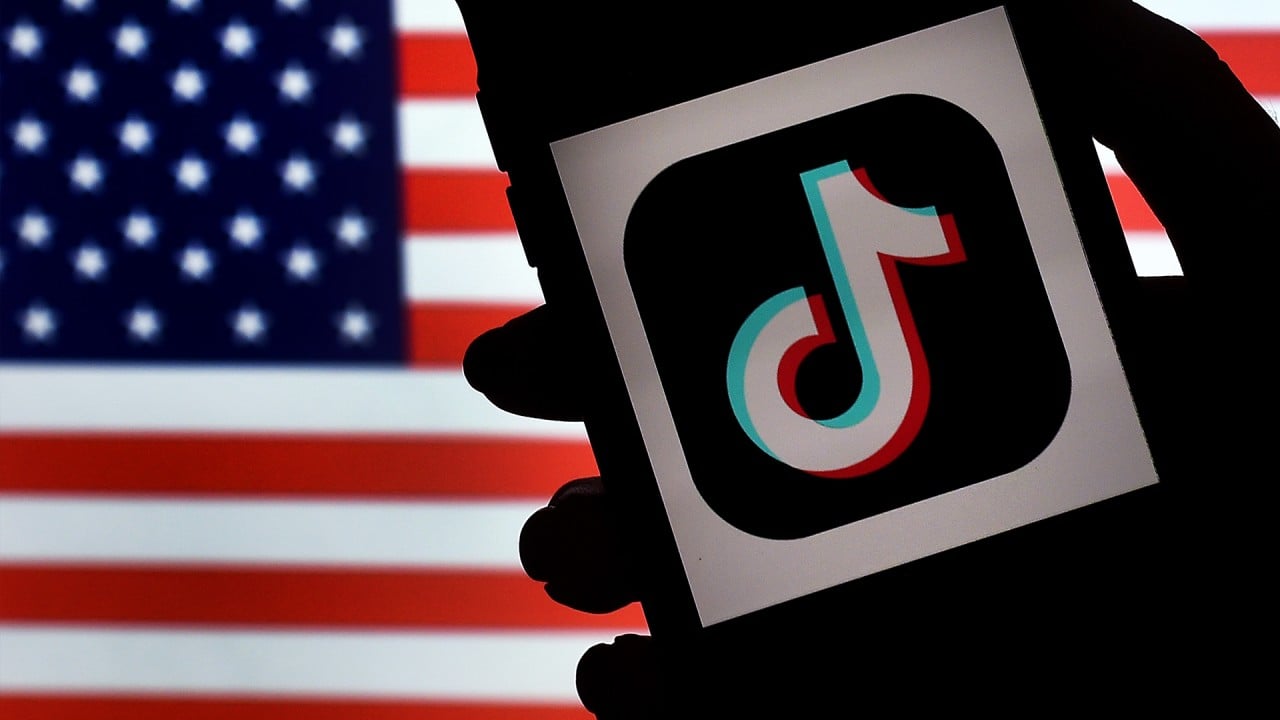

Stop offering ‘untrusted’ Chinese apps like TikTok and WeChat, Washington urges US tech companies

The currency is being used for multiple payment methods, including bar code, facial recognition and tap-and-go transactions, Fan said.

The government also used e-yuan red packets, in cooperation with the Shenzhen government, to reward about 5,000 medical and health care workers involved in the treatment of Covid-19, the disease caused by the coronavirus, Fan said. The electronic red packets can be used at designated merchants in Luohu.