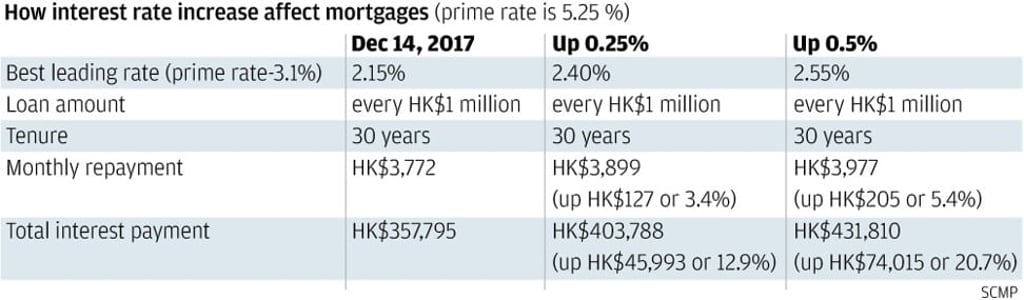

Explainer: What Hong Kong’s interest rate increase means for Hibor, prime and mortgages

Hong Kong Monetary Authority (HKMA), the city’s de facto central bank, today raised its base lending rate for the third time this year following a similar move by the US Federal Reserve, increasing it by 25 basis points to 1.75 per cent.

What is the base lending rate?

It is the interest that banks pay on money they borrow from the Hong Kong Monetary Authority. Individuals or companies do not borrow money at this rate.

How do higher base lending rates affect mortgage rates in Hong Kong?

It doesn’t have a direct effect as almost all mortgage rates are either linked to Hibor (the Hong Kong Interbank Offered Rate), or linked to prime rates, which are set by banks. The city’s biggest lenders

such as HSBC, Bank of China (Hong Kong), and Hang Seng Bank have a prime rate of 5 per cent. Standard Chartered and Bank of East Asia set their prime rate of 5.25 per cent.

How are Hong Kong’s mortgage rates priced?