Banks, tech firms in Beijing, Shanghai, Shenzhen to drive demand for prime office space as China’s economy prospers

- JLL and CBRE forecast a sharp rebound in demand for premium office space this year as recovery gains momentum

- Rent concessions during the pandemic have opened a window of opportunity for tenants to upgrade and expand their office space strategy, CBRE says

Demand for high-quality office space in China is expected to strengthen from next quarter as more companies prepare to upgrade and expand their requirements while the business outlook improves, market analysts said.

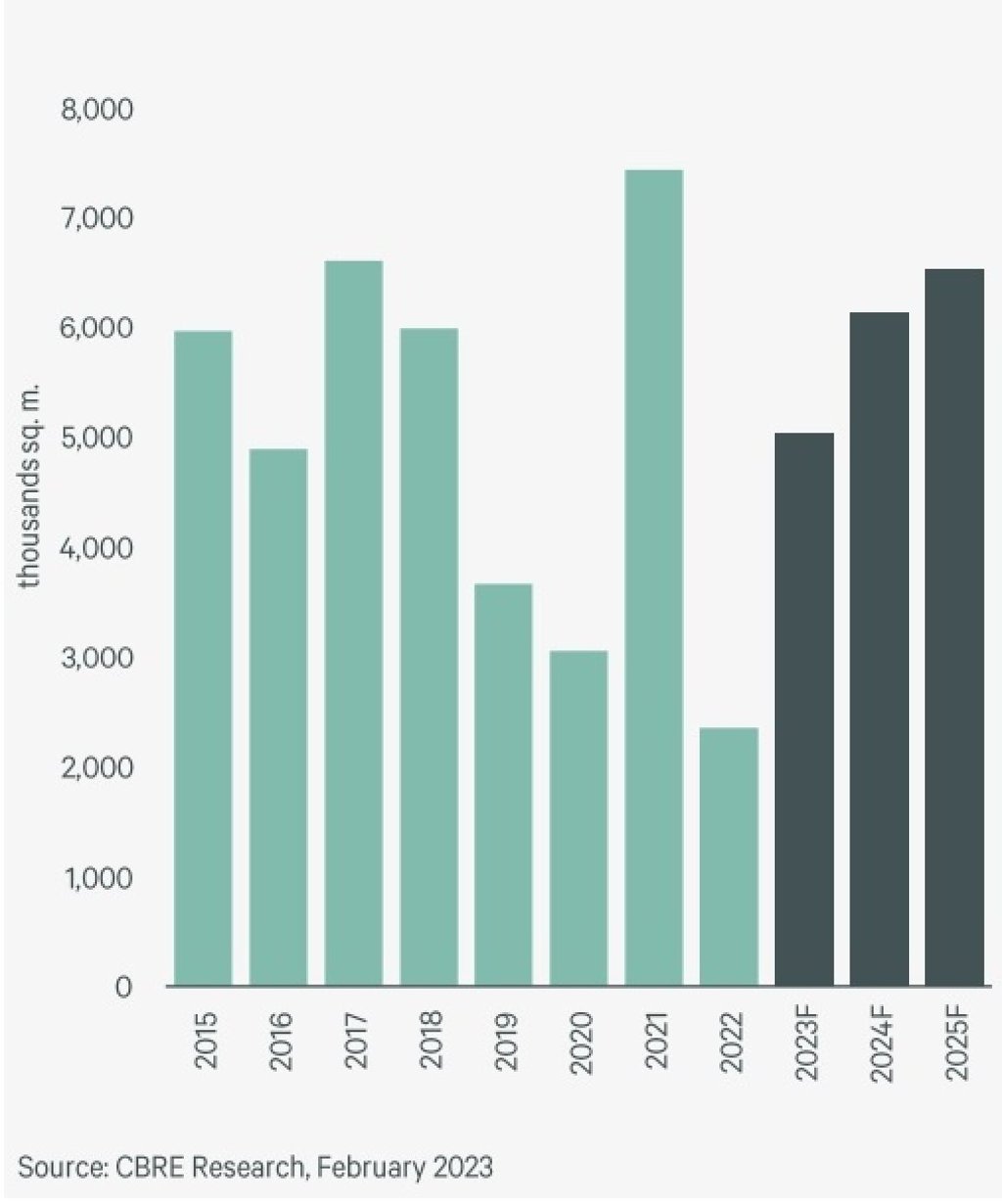

Net absorption in grade A office space in 20 major mainland cities is expected to almost double to 4.9 million sq m this year, according to forecast by real estate consultancy JLL. CBRE, which estimates about 5 million sq m for 2023, said only 2.34 million sq m found new occupants in 2022, a 68 per cent drop from 2021.

“This is a year of recovery for China’s office market,” said Mi Yang, head of office research at JLL China. Businesses are restoring their operations after a sluggish period and are now readjusting their office space strategy before the market strengthens further, he added.

During this economic transition, companies are looking at spaces, management and maintenance services to find a property and location that can help them stay competitive, he added.

An increase in net absorption means the total amount of space occupied by tenants exceeds the amount vacated by others during a given period.